The Pandemic Boom Goes Bust

The Music of Today’s Mania is Slowing… Find a Chair Before it Stops

Welcome to the great fiscal hangover.

Over the last 18 months, the U.S. economy enjoyed the greatest stimulus infusion of all time. More than $5 trillion was borrowed and injected directly into the pockets of consumers and businesses. This unleashed a consumption binge of unprecedented proportions. Americans bought so much stuff, we literally clogged up both domestic and international supply chains.

But there’s a reason why stimulus often gets compared to taking drugs. It produces a temporary high, followed by a painful hangover. And that’s precisely what’s coming in 2022, as the U.S. economy faces an epic mean-reversion in consumption:

We all learned at an early age that there’s no such thing as a free lunch. The same applies to economic policy. Sure, we created a tremendous boom by injecting trillions of borrowed dollars into the economy over the last 18 months… but at what long-term cost?

The Inflation Bill Comes Due

The bill from yesterday’s stimulus binge is showing up in the form of higher prices across the board. With inflation running at 40-year highs of 7%, the cost of living is rising faster than incomes. After enjoying a short-lived surge, inflation-adjusted wages have now reversed course, recently dropping by the most in over 40 years:

It’s no surprise why U.S. politicians are panicking, blaming “greedy corporations” for today’s higher prices. They know that the following chart of crashing consumer sentiment - now below the COVID lows - spells a death knell for their re-election prospects:

Of course, corporations didn’t suddenly wake up and become greedy in 2021. Rising prices are the expected and natural consequence of conjuring up trillions of dollars and flooding it into the economy.

More and more Americans are waking up to this fact. At some point, voters will start asking: what’s the point of all this stimulus, if it only ends up making us poorer? That’s why we’re seeing pushback from people like Senator Joe Manchin, refusing to vote for more reckless debt-financed stimulus spending. This rejection of more reckless fiscal stimulus is best for the long-term health of the economy and country. But like withdrawing from any drug, the initial stimulus withdrawal will create a lot of pain in the short run.

The backlash against inflation is forcing the U.S. Federal Reserve into tightening monetary policy, just as we’re seeing the early signs of a slowing economy - a disastrous combination for risk assets across the board.

Weak Manufacturing and Retail Sales Data Indicates a Slowing U.S. Economy

The graphic below from Morgan Stanley research details the growing body of evidence indicating a substantial slowdown in the U.S. manufacturing sector:

Meanwhile, collapsing real wages and consumer sentiment is showing up in the retail sales data. In December, the U.S. consumer posted a -2.3% decline in retail sales on an inflation-adjusted basis. This reflects the biggest retail sales decline since the Global Financial Crisis. Real disposable income in the U.S. is now tracking below the pre-COVID trend. In other words…

The U.S. consumer has given back all of the temporary stimulus-driven income gains and more.

Such is the nature of debt financed stimulus. After all, we didn’t create any new wealth. We simply pulled forward from the future. And now, the future has arrived.

The financial markets have been sending off warning signals of this coming fiscal cliff for months now. In the bond market, the spread between short and long duration Treasuries - a key measure of future growth expectations - indicates that U.S. economic growth entered into a consistent decline after peaking with the last round of stimulus checks in Q1 2021:

The stock market is sending off its own warning signals, through a growing number of high-profile single stock blow ups. The latest disaster du jour comes from fitness equipment maker Peloton Interactive (PTON).

Peloton Shows the Pandemic Pull Forward is Over

Last Thursday, Peloton shares plunged by 25% after the company announced a production halt for its bikes and treadmills, citing softer than expected demand.

The drop caps off an 85% share price wipeout over the last 12 months.

Of course, there were plenty of warning signs for those who cared to look. Perhaps the biggest red flag was the share selling spree among corporate insiders, who dumped $500 million in Peloton stock in the months leading up to Thursday’s price collapse.

These insiders apparently knew then what we all know now: Peloton’s windfall from stimulus checks and stay-at home orders in 2020 was a one-time boost that simply pulled forward a lot of future demand into a 12-month sales blitz.

By Q2 of 2021, the great pandemic pull-forward in Peloton demand began pushing back. Here again, growth peaked with the last stimulus checks that went out the door in Q1 2021:

The problem with the share prices of pandemic winners like Peloton, Zoom (ZM), Docusign (DOCU) and countless others was that Mr. Market extrapolated a one-time demand surge into the indefinite future.

At its peak, Peloton commanded a ludicrous $50 billion valuation, reflecting a sales multiple exceeding 10x. The narrative followed the share price higher, as Wall Street conjured fantastic notions about the company earning software-like margins at scale, with a seemingly infinite TAM (total addressable market) to grow into.

Of course, after an 85% share price decline, it all seems so obvious. Peloton is nothing more than a commoditized, low-margin hardware manufacturer with no moat and a limit on its growth prospects. For the first nine months of this realization, the share price suffered a slow burn of smart money selling to the dip buyers. The slow burn phase was then followed by three months of sheer capitulation:

Peloton provides a great case study for the speed and scope of wealth destruction possible when delusional Wall Street narratives born from a mania meet financial reality during the subsequent bust.

Can we think of any other high-profile businesses selling low-margin, commoditized hardware products, but which command a delusional software-like valuation multiple exceeding 10x sales? Stocks where the business has heavy exposure to the coming mean reversion in consumer demand, and where insiders have recently liquidated billions of dollars in stock?

Oh, right - Tesla (TSLA).

Tesla - the Next 90% Share Price Wipeout Candidate

Tesla will be reporting earnings just as this article goes to publication today. But in my view, any “fundamental” news coming from Tesla’s earnings is rather meaningless. Why? Because we’re talking about a company completely divorced from any semblance of fundamental value. Consider the following…

From 2019 to 2021, Tesla’s sales roughly doubled from around $50 billion to just under $100 billion. And over the same period, Tesla’s valuation ballooned from $50 billion to over $1 trillion. So, we’re talking about a car company trading at a 10x sales multiple.

Need I say more?

Of course, I fully appreciate that the bulls have plenty of elaborate narratives to justify why Tesla should trade like a world-class software monopoly with 80% profit margins and unlimited future growth prospects. But that was the whole point of the Peloton example - these are the stories that get invented to justify price action during manias.

In my mind, the only real factors that matter for Tesla’s share price are crowd psychology, price momentum and money flows. The bet here distills down to one question: does today’s mania have more room to run, or is it about to go bust?

Unfortunately for Tesla shareholders, all signs point towards bust in 2022.

Peak Money Flows = Peak Mania

Earlier I showed how trillions of fiscal stimulus dollars went into record U.S. goods consumption over the last 18 months, and how that’s a big problem when the mean reversion hits in the coming year.

But there was another key area where the fiscal stimulus funds poured into: financial markets. The chart below shows how the inflows into the U.S. stock market last year exceeded the sum total of the past 19 years… combined:

And just like we’re starting to see in the real economy, I believe we’ll see a similar mean reversion in money flows in 2022 - which the chart above shows may have already begun.

Tesla was one of the primary beneficiaries of the chart above. In perhaps one of the greatest market timing feats ever, Tesla entered into the S&P 500 in December of 2020 - just before a record liquidity tsunami washed over the U.S. financial markets.

But now, with the fiscal stimulus taps shut off, money flows have peaked and started reversing. It should also come as no surprise that the broader stock market, along with Tesla, has stopped going straight up and become much more volatile in recent weeks.

Looking beyond just equity market inflows, Tesla shares also benefited from the greatest speculative option frenzy of all time.

I (along with many others) have covered in great detail how surging call option volumes can create a “gamma squeeze”, which creates artificial buying pressure from option dealers hedging out their gamma exposure in the underlying share price (see more here).

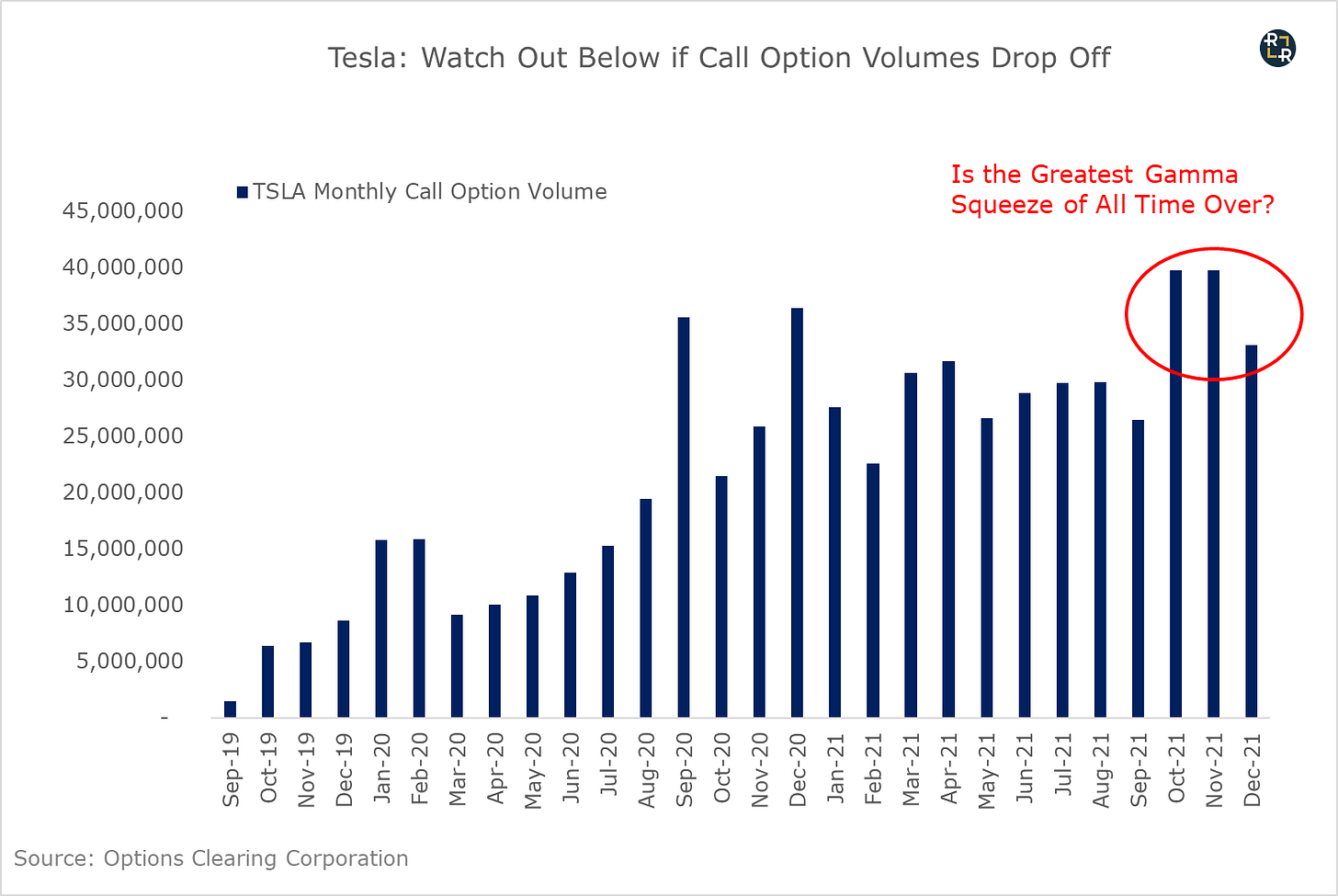

To make a long story short, I believe Tesla benefited from the massive amount of stock required for option dealers to hedge their risk as monthly call option volumes exploded from 1.5 million in September of 2019 to nearly 40 million contracts in November of 2021:

But again, this call option frenzy is the stuff of a manic market environment. As the liquidity tide recedes in a world where boom turns to bust, Tesla shares could face an epic unwind of the greatest gamma squeeze of all time. We may have already seen the start of this process, with Tesla shares peaking precisely with the peak in call option volumes in November of 2021.

Stay tuned for more updates, as this could become a critical piece of the story not just for Tesla shares, but for the broader financial markets going forward.

For now, here’s the bottom line: anyone looking at Tesla’s business fundamentals as the key driver for the share price will find themselves increasingly confused in 2022. Fundamentals could very well continue improving for Tesla, and the share price could still lose 90% of its value as the speculative money flows reverse course.

Finally, it’s not just the story stocks like Tesla and Peloton that are vulnerable in today’s market. We’re starting to see selling pressure hit the former market generals - the FANNGs - another giant warning sign for today’s bull market.

Market Generals Starting to Drop

One of the leading indicators for a market transitioning from boom to bust is a sharp deterioration in the most speculative stocks. Last year was a textbook example, as the market’s most speculative cash burning companies - including the recent string of low quality IPOs, SPACs and virtually every holding in the ARK Innovation ETF (ARKK) - flipped from market leaders in 2020 to market laggards in 2021:

Jeremy Grantham describes this late cycle phenomenon as the “confidence termites” eating away at the outside of the bull market, before making their way into the foundation. For much of 2021, money moved away from these speculative stocks into the blue chip mega cap leaders - notably the FAANNG+ (Facebook, Amazon, Apple, Netflix, Nvidia, Alphabet, etc.) stocks.

But here’s the troubling sign for bulls - the confidence termites have now made their way to the former mega cap market generals, starting with Netflix.

After posting weak guidance for future subscription growth in its latest earnings report, Netflix dropped by more than 20% in a single day. The stock is now down over 50% from the highs made as recently as November 2021:

In the last few weeks, we’ve seen the selling pressure creep into the other generals. Most notably, shares of stalwart Amazon (AMZN) are now down 25% from their recent highs - and that’s despite any real meaningful fundamental news.

This deterioration in the former generals is the biggest indicator yet that the game has changed, and the bull market is on its last legs. And I believe Apple could become the next market general that gets taken out.

Apple: the Next Market General to Take the Fall?

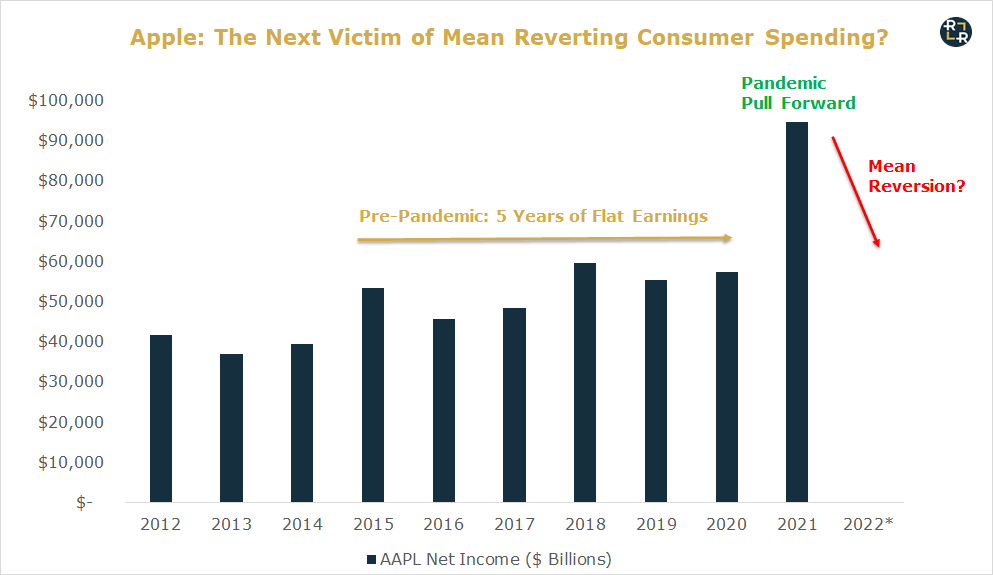

Apple was clearly one of the biggest pandemic winners, as stimulus money plus the work from home boom boosted demand for the companies iPhones, tables, computers and services across the board. Apple’s net income nearly doubled from just over $50 billion pre-pandemic to $100 billion in 2021:

Back in mid-December when I first made the bearish case for Apple, the stock commanded a roughly $3 trillion market capitalization. That reflected a 30x valuation multiple on what I believe could turn out to be peak earnings. So far, the bet has paid off… but there could still be a lot more room to run on the downside for Apple.

Even after the recent market turbulence, the stock today trades for just over 26x trailing earnings. That might not seem like a crazy high valuation, but remember - that’s measured off of the earnings from a record consumption binge that could mean revert in a big way going forward.

The truth is, Apple is primarily a hardware company subject to both broader consumer spending patterns as well as the cyclicality around new iPhone product launches. If consumer spending takes a hit and/or buyers don’t believe the latest iPhone model offers enough new features to justify an upgrade, that’s a big problem for Apple.

Early indications suggest Apple could face lackluster demand for its new iPhone 13 . By some accounts, the new phone model offers a rather muted series of feature upgrades over the previous model. We might find out in 2022 that consumers are tapped out and not willing to spend $750 for the new base model iPhone 13.

Apple has already issued warnings regarding the outlook for the new iPhone 13 model, including a production downgrade of 10 million units due in part to softer than expected consumer demand.

So the question for Apple investors becomes: what if the company enjoyed a one-time pull forward in demand in 2021, which sets the stage for mean reversion in 2022?

What if the company’s net income drops to $75 billion in 2022, and investors decide they don’t want to pay more than 15x earnings - in line with the historical average. That’s a scenario where the share price could fall by more than 50% from current levels, and one which wouldn’t even require a very extreme set of circumstances.

Apple reports earnings later this week, and it will be a key stock I’m watching to see if we lose another key member of the narrow FAANNG leadership. In which case, it could be game over for this bull market.

Finally, looking beyond any single stock, the broader macro picture should give investors plenty of reason for a cautious stance going into 2022.

The fiscal hangover will pressure consumption in the real economy, as well as reversing the record money flows that helped inflate the stratospheric valuations across today’s stock market. We’ve seen the first signs of boom turning to bust, and the Fed will soon be tightening monetary policy into a slowing economy.

That’s a recipe for lower earnings growth, a slowing economy, and lower valuations.

The takeaway: don’t expect 2022 to look anything like 2020 or 2021.

If you enjoyed this article and want to see more content, please like, share and subscribe below:

another particularly vicious aspect of the current market is that consumer spending and equity valuations are closely tied together. As tech stocks fall, spending will decrease, putting even more pressure on the fundamentals of these businesses. 50%+ drops from the peak are bad enough for those who hold a given company's stock directly, but many market participants chose to borrow money in order to purchase far out of the money call options. They are getting wiped out immediately. The "loss porn" category on Twitter and Reddit is instructive here.

The gamma- and short squeeze tailwind for Tesla has faded, now they are starting to fall together with the other companies in the S&P500 - once ETFs on this index face outflows (due to inflation fears and the associated expectation of interest rate hikes for example), there will be tremendous selling pressure on Tesla.

Good read. Good to know the other side. I invested in both PTON and TSLA. Here are some of my thoughts for you to consider. In case of TSLA, I did not see any comments on how TSLA was able to exponentially increase the bottom line (not only the top-line unlike PTON). If you see the PE ratio it is decreasing exponentially and going to do the same thing in coming years with increase in both top-line and bottom-line. This will put the PE ratios somewhere between 50 to 75....which is not insane (like you try to interpret) for TSLA which is growing its top-line by 50% for next 3-5 years. If you compare with PE ratio of AMZN, TSLA multiple is reasonable especially when you keep in mind that AMZN is growing in single digits going forward with gross margins less than TSLA. These are some pointers for you to consider.