The Most Dangerous Stock Market Ever

The speculative excess in today's market shares no precedent

In 2013, Bruce Burnworth was nearing retirement. But he needed money - and fast.

No, he didn’t pull a Breaking Bad and become a crystal meth kingpin. Instead, Burnworth turned to Wall Street, as he explained in a podcast interview:

I was looking for ways to increase the money that I’d have for retirement. I thought stocks would be too slow and I needed something faster, so I did a lot of research into stock options.

Thanks to the inherent leverage available with options, Burnworth quickly turned an original investment of $100,000 into $800,000. And then, just as quickly, he ended up back at zero. It’s a familiar story in the world of derivatives and leverage — fast gains, and even faster losses.

Undeterred, Burnworth regrouped and saved another $20,000 to try his luck again. In 2019, he made an all-in bet on Tesla call options. And this time, he hit big. As Tesla shares surged nearly 20-fold from the lows in 2019, the original $20,000 investment ballooned into a multi-million-dollar fortune.

Here’s Burnworth looking triumphant in his picture for a Wall Street Journal profile:

Unfortunately, this story likely ends in tears. Why? Because instead of cashing in his winning lottery ticket (and yes, betting it all on a single options trade is gambling), Burnworth continued pressing his luck.

First, he mortgaged his home to purchase more Tesla call options. Then, he began taking out margin loans against his Tesla position to fund daily living expenses. Burnworth explained his reasoning in a podcast interview as follows:

When I need money, I just borrow against the stock. Tesla has been going up 300% a year, so I don’t mind paying 4.25% interest...For example, helping my daughter buy a house, or helping my daughter-in-law to buy a Tesla. I basically pull that money out of margin.

Incredible. This isn’t a 25-year-old playing with “YOLO” money. We’re talking about a now-retired man who started trading because he needed retirement money. And despite literally hitting the jackpot with the riskiest bet possible – an all-in gamble on call options – he refused to take money off the table. Instead, he’s taking out margin debt to fund living expenses, because of his unshakeable belief that Tesla shares will only head in one direction: higher.

So, what’s the point?

I’m not here to call out Burnworth as a fool. Quite the opposite. From his interviews, it’s clear that he’s both intelligent and well-spoken. Plus, he’s enjoyed a long career working as a civil engineer. We’re not dealing with a low-IQ individual here.

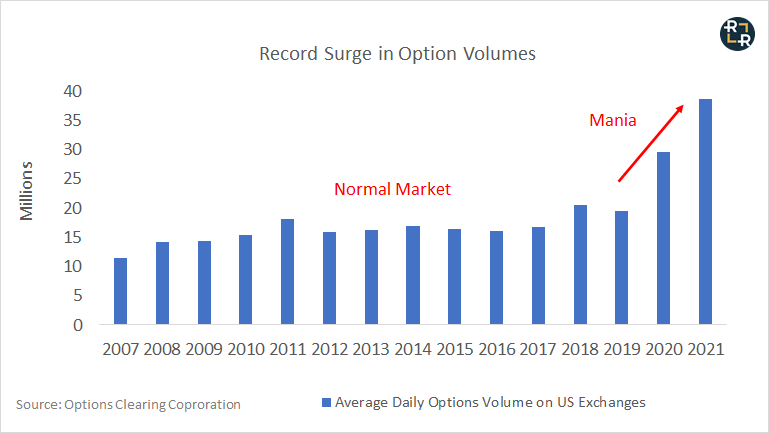

Burnworth’s story is just one example of the broader mania sweeping through financial markets - an alarming trend of speculators making all-in, leveraged bets on some of the riskiest securities in the market. Things like options trading, where volumes have exploded unlike anything we’ve ever seen before:

Meanwhile, speculators have taken out record volumes of margin debt to finance stock purchases, to the tune of nearly a trillion dollars:

This speculative excess is part of the growing body of evidence indicating extreme fragility underlying today’s market. Meanwhile, the rise of social media has added fuel the fire - creating a self-reinforcing echo chamber of bullish enthusiasm.

In today’s article, I’ll explore how these trends have combined to fuel a mania of unprecedented proportions, and why this is the most dangerous stock market ever.

In future articles, I’ll begin diving deeper into a few ways to play the coming unwind of today’s mania. Strategies for betting against stocks which have inflated beyond any reasonable price justified by business fundamentals.

However, consider this article a necessary precursor to any future fundamental analysis. Why? Because in today’s market, short-term price movements often have absolutely nothing to do with business fundamentals.

On that note, let’s begin with a discussion on the increasingly dominant force shaping short-term stock price movements: speculators in the options market.

Options: the Tail Wagging the Dog on Wall Street

In the old days, options trading volumes paled in comparison to stock market volumes. After all, options are a derivative product designed to provide a form of insurance for stock investors. No one ever imagined they’d become a primary asset class, overshadowing the underlying instrument they were designed to insure against.

But in today’s market, all rational precedent has been overturned. Thanks to a record influx of speculators looking to make leveraged bets in today’s market, options trading volume recently exceeded that of the stock market, per The Wall Street Journal:

This is a big deal. It means that the options market increasingly determines the price of stocks, instead of the other way around. For those new to options, here’s how it works in the case of a call option…

The Age of Weaponized Gamma

When a speculator buys a call option to bet on higher stock prices, the market maker who sells the option becomes net short the underlying stock. That means the options dealer will often hedge their short position by purchasing the underlying stock.

Importantly, because of the convexity inherent in options, this hedging is a dynamic process. The higher the share price goes, the larger the dealer’s short position becomes. The Greek term used to denote this relationship, between the stock price and option price sensitivity, is known as “gamma”. Without going too deep into the weeds, here’s the bottom line…

As the stock price rises, call option gamma increases, forcing the dealer to buy more stock to hedge their growing short position. With enough options activity, you can imagine how this process becomes self-reinforcing. That is, the more call options speculators buy, the more stock the dealer must purchase as a hedge. The dealer’s buying pressure can send the share price higher, which in turn, creates an even greater need to hedge, etc. etc.

This self-reinforcing cycle is known as a “gamma squeeze”. Gamestop (GME) provided a textbook gamma squeeze examples earlier this year. It all started with monster call option volumes, as The Wall Street Journal explains…

“On Jan. 27, when GameStop Corp. shares jumped 135%—their largest single day move on record—more than $53 billion worth of the company’s options changed hands, well above the roughly $32 billion that traded in its stock, according to a Journal analysis of Cboe data.”

And that’s how speculators transformed the terminal share price decline of a dying retailer, into one of the best performing stocks in the entire market:

Despite no appreciable improvement in its core business, GameStop now trades several thousand percent above its pre-gamma squeeze levels, commanding a mammoth $14 billion market capitalization.

The takeaway? You can officially throw out your textbooks on fundamental analysis and efficient markets. In today’s market, speculators have learned to weaponize gamma, and drive stock prices through the power of options flow alone - fundamentals be damned.

My view: it’s only within this context that many of today’s stock prices can be properly understood. With that said, let’s revisit our Tesla discussion…

Tesla: the Greatest Gamma Squeeze of All Time?

In the last 2 years, Tesla shares surged nearly 20-fold from a split-adjusted $50 per share to as high as $900, before settling in at around $800 today. With roughly 1.2 billion fully diluted shares outstanding, that puts Tesla’s current market capitalization at nearly $1 trillion.

In future articles, I’ll explore Tesla’s core business in great detail. But you only need surface level analysis to appreciate how detached Tesla shares have become from financial reality. After all, we’re talking about a company that will generate a couple of billion dollars in net income this year. More than 100% of those profits will come from two sources:

1) Regulatory emissions credits, which will soon dissolve as legacy automakers ramp up their electric vehicle production in 2022 and beyond

2) “Full Self Driving” software, which looks increasingly vulnerable to a regulatory crackdown (more on this later).

For the moment, let’s look past these major headwinds that could render Tesla’s core business structurally unprofitable. Let’s instead give Tesla full credit for $2 billion in annual earnings power, and assign a generous 25x earnings multiple (versus 8 - 12x industry standard). These optimistic assumptions support a roughly $50 billion valuation.

As it turns out, that’s roughly what Tesla traded for in September of 2019, at around $50 per split-adjusted share.

Meanwhile, in September of 2019, option traders exchanged about 1.5 million Tesla call options during the month, per the Option Clearing Corporation. This is roughly in line with what you might expect for an actively traded, large-cap U.S. stock.

But starting in October of 2019, something strange happened…

Tesla call option volumes spiked into the stratosphere, surging from 1.5 million to over 6 million contracts. That’s a more than 4-fold increase from the prior month, and volumes only went higher from there. By January 2020, Tesla call volumes had ballooned 10-fold to over 15 million contracts. And after a brief hit during the COVID market meltdown, call volumes continued growing to as high as 36 million by December 2020.

That’s a 25x increase in Tesla call option volume from September 2019 through the peak in December 2020, which corresponded with a nearly 20x share price increase over the same period.

Naturally, the trillion dollar question then becomes…

Did rational investors decide Tesla’s fundamental business value grew from $50 billion to $1 trillion in just 18 months? Or, did Tesla’s stock enjoy one of the greatest gamma squeezes of all time?

My bet: Tesla’s share price, along with the broader stock market, has inflated under the tailwind of a record option buying spree over the last 18 - 24 months. In the case of Tesla, it’s instructive to note that the share price leveled off just after call option volumes peaked, starting in January 2021:

Reading the tea leaves, this levelling off in option volumes and share price performance suggests that Tesla’s days of parabolic price gains are in the rearview. Now, the stage is set for an equally powerful move in the opposite direction. Why?

Because, as in every mania, the crowd has piled in at the top of the market. The momentum buyers who will become momentum sellers when prices stop going up. And thanks to the record amounts of leverage at work in today’s market, things could get very ugly on the way down.

Our next anecdotal story provides a glimpse into what’s coming for both Tesla shareholders, and the broader speculative mania, when boom turns to bust…

Playing Russian Roulette with Mr. Market

Jason DeBolt’s story shares many parallels with Bruce Burnwoth’s. DeBolt is a talented former software engineer, who previously worked for the likes of Facebook and Amazon. He began making an all-in bet on Tesla back in 2013, and for most of the last 8 years, he was a relatively obscure figure on social media.

That was, until his all-in Tesla bet paid off in a big way.

As Tesla shares soared into the stratosphere earlier this year, DeBolt took to Twitter to announce his formal “retirement” at age 39. In the announcement, DeBolt touted his windfall gain in Tesla shares, including the following brokerage snapshot:

The post garnered over 30,000 likes, propelling DeBolt into overnight financial guru (FURU) status. With DeBolt’s newfound celebrity, he now regularly drops investing “knowledge” to his growing legion of Twitter followers. In the following exchange, he advises his audience on the benefits of following the Burnworth playbook: taking on margin debt to fund living expenses. He then explains why this scheme is foolproof - because Tesla shares “will appreciate faster than the margin debt”:

A lot to unpack here.

First, by refusing to sell any Tesla stock, and instead simply take out margin debt against the position to fund daily living expenses, DeBolt and Burnworth and countless others are playing Russian Roulette with Mr. Market. That is, taking catastrophic risk and hoping the proverbial revolver chamber comes up empty.

So far, it’s worked brilliantly. During a mania, the revolver chamber can come up empty for months, even years on end. Along the way, those taking the most risk reach the highest levels of hero status. Meanwhile, the windfall gains from taking excessive risks creates a powerful delusion that the speculators has “figured out” the market:

Mistaking Brains for a Bull Market

Now, this is not an attack on DeBolt’s intelligence. In fact, personal experience reveals that the “mistaking brains for bull market” phenomena affects high-intelligence individuals the most. Why? Because smart people are accustomed to being able to solve problems. So when they hit the proverbial stock market jackpot, their natural instinct is to believe that they’ve “figured out” the market.

But the market isn’t a physics or math problem that can be solved. It’s a reflection of human nature. Thus, the market will always be unpredictable by nature. Isaac Newton laid it out in simple terms, after going broke during the South Sea Bubble, explaining…

“I can calculate the motions of the heavenly stars, but not the madness of people”

Anyone who believes they know with full certainty the future path of stock prices is effectively saying they’ve figured out the madness of crowds. The best investors accept the futility of such an exercise. They embrace the inherent uncertainty of markets, and thus only talk in terms of probabilities and risk. The mark of an amateurs is talking about the market in terms of certainty.

An unshakeable sense of certainty is a common theme among the high-profile Tesla investors. Here’s Bruce Burnworth’s pinned Tweet explaining how his 10,000 hours of practice enabled him to “KNOW” how much Tesla shares will go up and over what time period:

It’s this false sense of security that has enabled Burnworth, DeBolt and others to refuse to cash in their winning lottery tickets. After all, if it’s your personal genius responsible for the gains in your brokerage account - and not the bull market itself - then the only logical next move is to keep pressing your bets.

Thanks to the rise of social media, this amplification effect has never been more powerful.

Social Media: a FOMO Force Multiplier

At no other time in history has the average Joe been able to wield so much influence over the masses. Consider the following Twitter post, in which DeBolt claims he has personally influenced upwards of $200 million into his all-in, leveraged Tesla bet:

This is a big part of what has made today’s mania particularly powerful. In the old days, you might hear about a neighbor or co-worker who stuck it rich in the stock market. Today, total strangers can blast out their life-changing gains to millions with the click of a button. Never before has it been so easy to spread stories of life-changing wealth, triggering record levels of “fear of missing out” (FOMO), and enticing the masses to try their hand at the Roulette wheel.

Unfortunately, it rarely works out for the follow-ons who try to replicate the success of the early mania adopters, like DeBolt and Burnworth. Their stories tend to come out after the easy money has already been made.

Recall that DeBolt posted his retirement announcement on January 7th, when Tesla shares closed at $815. The stock then enjoyed a brief run to $900, before plunging 40% within two months. How many leveraged traders got wiped out from this immediate 40% whipsaw? How many more will lose everything if the stock drops 95% from current levels?

Don’t expect any clear answers. The stories of traders who lose everything don’t typically get blasted out all over social media. The crowd only wants to hear about the heroes and the bullish takes.

A recent Wall Street Journal article profiled the brave new world of so-called financial “influencers” doling out financial advice on social media. These influencers naturally gravitate towards the content that gets the most clicks and views. In simple terms, that means always be bullish, as the article describes:

Many influencers report that when they hype an investment, they get the page views they crave. When the message is bearish, however, viewers turn away, or worse, attack the messenger with vicious trolling.

Meanwhile, what qualifications are needed in this brave new world of financial guidance? Some notable luminaries noted in the Journal piece include 20-something personal fitness trainers and college dropouts.

What could possibly go wrong?

The End Game: All-In Today = Forced Selling Tomorrow

In last week’s article, I argued against focusing on “catalysts” for a bear market. In reality, you can distill a bear markets down into one thing: forced selling. The degree of forced selling is proportional to the amount of speculative excess and leverage accumulated during the bull market.

Given all of the evidence laid out in today’s market - including record margin debt, record speculative option flows, and general maniacal sentiment permeating throughout social media - the fallout from the coming bear market could set new records.

So far, I’ve mostly focused on the speculative excess among retail speculators. But the truth is, the all-in mentality has permeated beyond just the speculators. If we zoom out and look at the total flows into the U.S. stock market, 2021 is on track to pull in more cash into the stock market than the last 20 years… combined:

Meanwhile, U.S. households have the largest exposure to the stock market ever - even exceeding the prior peak made during the Dot Com bubble:

In other words, it’s not just the day traders this time around. Everyone, everywhere across the board has gone all-in on today’s mania. We’ve never before seen so much capital and speculative excess all betting on one outcome: a perpetual rise in asset prices.

So, how does it all end?

It starts when there’s simply no more dry powder left to push prices higher. As the initial selling starts, the momentum-based investors begin cutting their losses. Then, the leveraged buyers that were all-in at the top of the market start getting margin calls, which creates a proverbial “air pocket” where there’s only sellers and no buyers.

Instead of “buying the dip” when inevitable corrections occur, small declines now risk snowballing out of control into larger declines. That’s how you get a market crash - which is simply a reflexive situation, where lower prices cause more selling, not less. This can only occur when market participants put themselves in a position to suffer from widespread forced selling.

Given the record leverage and speculative excesses in today’s market, this is quite possibly the most dangerous stock market of all time. In future updates, I’ll begin detailing tactics and strategies for how to hedge against today’s extreme risks.

Current subscribers, stay tuned for future updates!

If you haven’t yet, hit the subscribe button below:

Since buying puts on Tesla is too expensive, seems like we could buy the ETFs with most Tesla holdings. Consumer Discretionary Select Sector SPDR Fund contains 18% tesla

Excellent, fascinating report. I’ve got a question. When you say that options volume has risen above stock volume, how are you measuring the volume? For instance, are you comparing the value of the shares traded to the value of the securities underlying the options traded?