Shale Bust Sets the Stage for Oil Supercycle

I can still smell the crude oil and chemical solvents…

It was 2012, and I was fresh out of college working my first “real job” in the oilfield service sector. One of our key clients was facing a big problem: persistent wax build up within their oil wells and wellsite infrastructure. Normally, clients would send oil samples to our lab in Houston. That way, we could find a solution from the relative convenience of an air-conditioned laboratory.

But time was of the essence.

So our team traveled out to the field location in Gonzales, Texas - a small South Texas town that sits atop the Eagle Ford shale formation. Working in an 8 x 10 foot trailer, we tested hundreds of different oil and solvent combinations to find the best wax-busting recipe. And it was all done in the dead of summer… with no air conditioning.

A great character builder for a fresh college graduate, or so I was told.

But beyond the blistering heat, the thing I remember most was how much the oilfield had swallowed up the entire town. As recently as 2009, Gonzales had been a sleepy town of just 10,000 people. The Eagle Ford was an obscure formation, churning out around 50,000 barrels of oil per day (bbl/d).

But everything changed when the shale boom showed up on the scene, starting around 2010. Companies like EOG had unlocked the Eagle Ford’s potential, blowing up production 10-fold to 500,000 bbl/d by mid-2012, on its way to a peak of 1.7 million bbl/d by 2015.

The oilfield descended upon the town, overrunning the roads with water haulers, equipment trucks, and an endless array of Ford F-250s sporting Halliburton and Schlumberger logos. You couldn’t walk into a restaurant, convenience store, or the local Wal-Mart without spotting half a dozen oilfield workers. The steel toe boot and protective coverall ensemble made them impossible to miss.

Perhaps the best boomtime indicator: rooms at the local La Quinta Inn went for over $200/night. And that’s if you were lucky enough to find availability.

In my youthful enthusiasm, I remember thinking how great this all was. We were living through the birth of a brand new industry that was going to make us all rich, right? Buying shares in shale companies seemed like the ultimate no brainer.

Of course, we now know the truth. The 2012 scene in Gonzales, Texas should not have left me feeling optimistic. Instead, I should left that trip feeling a lot more like this…

The Shale Bubble: Great Technology Meets Dismal Economics

Like most bubbles, the shale mania was built upon the promise of revolutionary new technology that would make investors rich.

The technology - horizontal drilling and hydraulic fracturing - weren’t exactly new concepts in the 2000s. However, these techniques suddenly became commercially viable with the introduction of things like optimized fracking fluid design starting around 2009 - 2010.

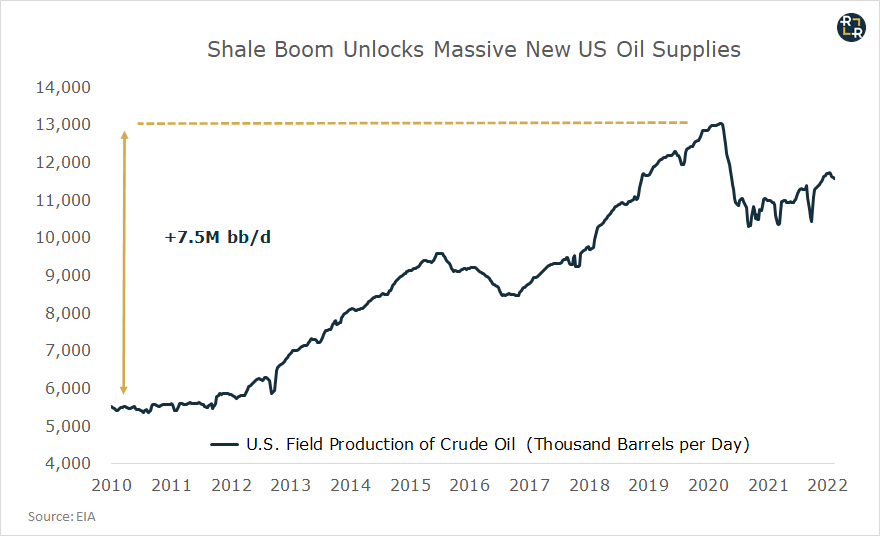

And there was a grain of truth in the story - this new shale technology did in fact unlock massive new supplies of hydrocarbons. Over the last decade, the shale boom unleashed an incredible 7.5 million barrels per day (bbl/d) of new U.S. oil production at its peak by March of 2020:

There was just one problem…

Shale drillers poured a lot more money into the ground versus what they could pull back out. Turns out, drilling 10,000+ feet sideways through the earth and pumping thousands of pounds of fracking chemicals downhole gets expensive. We’re talking $8 - $10 million to drill and complete a shale well versus roughly $2 - $4 million for your average conventional well.

Meanwhile, the record flood of capital pouring into the shale patch bid up costs across the board. Prices surged for land, labor, equipment and yes, even the hotel rooms in Gonzales, Texas.

Then, starting in 2014, energy prices collapsed when excess shale supply overwhelmed demand. And yet, investors continued throwing good money after bad in the shale patch from 2016 - 2019, allowing U.S. production to clear new all time highs. As a result, oil prices remained capped at around $60 per barrel.

The one-two punch of spiking input costs followed by “lower for longer” energy prices dealt a devastating blow to shale finances. The following summary from research consultancy Deloitte reveals the dismal state of shale economics over the last decade:

“The US shale industry registered net negative free cash flows of $300 billion, impaired more than $450 billion of invested capital, and saw more than 190 bankruptcies since 2010.”

The lesson? When a wall of money rushes in to capitalize on a hot new technology - run, don’t walk, in the opposite direction. Of course, the corollary also applies: when money flees an industry en masse, that capital exodus can leave behind tremendous opportunity in its wake.

That’s precisely what’s happening in today’s oil and gas industry.

Shale Boom Goes Bust

No matter how you slice it, the shale boom has officially gone bust.

Importantly, this doesn’t mean we won’t see new highs in U.S. oil production - we almost certainly will. The key difference now versus then: the flood cheap capital willing to finance non-economic production growth at $50 oil no longer exists.

Meanwhile, some of the key shale formations at the epicenter of the boom appear permanently impaired, including the Eagle Ford shale. Let’s revisit our “La Quinta” indicator from earlier…

Despite oil trading back at boom-time levels of $90 per barrel, the same La Quinta room in Gonzales, Texas goes for just $71 today. This should come as no surprise, given that drilling activity is down 70% from the former highs. Not even $90 oil can resuscitate the Eagle Ford’s dwindling production profile:

So, what happened?

First, the strategic priorities among both investors and shale executives have shifted. The days of “growth at all costs” are long gone. Today, it’s all about living within cash flows, as Bloomberg explains…

“For much of the past decade, shale producers spent every dollar they earned and borrowed extra to drill new wells. Producers would typically reinvest 120% to 130% of their operating cash flow in new production, according to Noah Barrett, a Denver-based energy analyst at Janus Henderson. Now, that figure is closer to 70% or lower, leaving plenty of cash for shareholder payouts.”

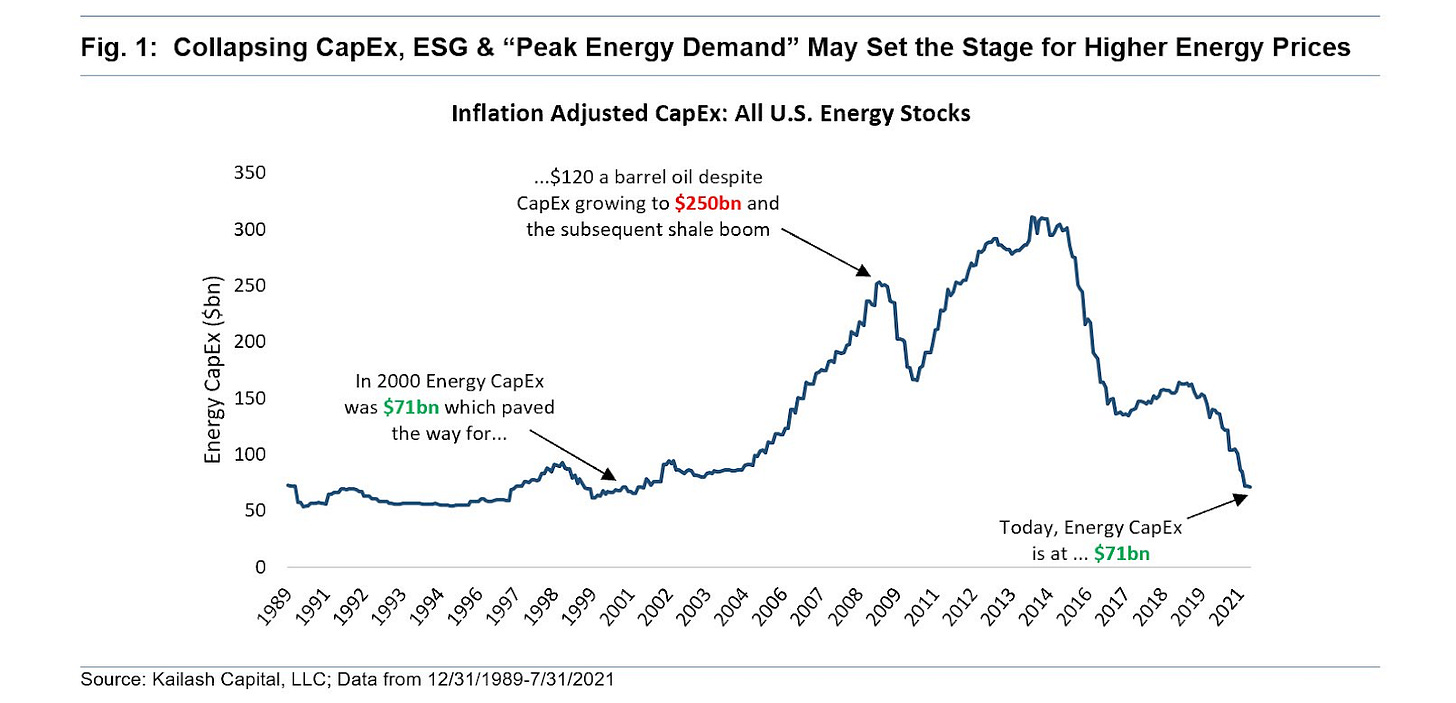

Next, the rise of ESG investment mandates have increasingly labeled fossil fuels an “un-investable” asset class. The end result: collapsing capital expenditures across the energy sector - even despite today’s high prices and attractive returns:

Therein lies the big bullish catalyst on the supply side of the oil equation: a lack of investment. Pulling oil out of the ground requires capital, plain and simple. And until more capital starts flowing back into the U.S. energy industry, don’t expect more oil to start flowing out.

We can see the evidence of today’s capital impairment in the numbers. Consider the following…

In 2019, oil prices averaged $57 per barrel. At the time, U.S. drillers deployed 774 oil rigs to produce an average of 12.3 million barrels of oil per day (b/d). But last year, prices averaged a much more attractive $68 per barrel. Despite these higher prices, U.S. drillers deployed just 380 rigs. That’s down 50% compared with 2019, resulting in U.S. production averaging just 11.2 million b/d in 2021:

Despite a 20% increase in oil prices, U.S. production dropped 1.1 million bbl/d last year versus 2019. That’s a sea change from the shale behavior of the last decade - when $60 oil invited new record highs in production.

Of course, at some point, high enough prices will revive shale growth. And based on current trends in rig counts, it appears that $90 oil might do the trick - particularly from the low cost Permian basin. But the key nuance here is simple: modest growth at $90+ oil is a whole different ball game vs aggressive growth at $50 - $60 oil.

At today’s prices, we should expect more supply to come online. But gone are the days of flooding the market with non-economic production. The hurdle rate for investment has gone up in the shale patch, and that’s great news for energy investors across the board.

This year, the U.S. shale industry will generate its best cash flow since the dawn of the shale revolution - $30 billion, based on current analyst estimates. I expect this is just the beginning of a decade of more rational behavior, and higher returns on invested capital across the sector.

Despite the best cash flows since the dawn of the industry, energy stocks across the board still trade at reasonably attractive valuations. Why? I suspect one of the big fears is that today’s high price environment will prove short-lived, and investors fear an inevitable return to the days of endless cash incineration.

But here’s where the story really gets even more interesting. Even if investors and shale executives wanted to bring back the growth rates of the shale boom, that option might not even exist anymore.

Let me explain why…

The Shale Milkshake Runs Dry

One key hallmark of any bubble is wildly optimistic forecasts of the security promoters of the day. During the shale bubble, C-suite executives kept shale share prices inflated based on overly-optimistic promises of future drilling inventory.

The problem, it turns out, is a little something called “drainage”. Oil tycoon Daniel Plainview brilliantly describes this concept in the epic film There Will be Blood (played by Daniel Day-Lewis), as follows:

“If you have a milkshake, and I have a milkshake. And I have a straw… And my straw reaches across the room. I drink your milkshake!”

Expanding a bit, Mr. Plainview describes a situation of two nearby oil deposits, where the first well sucks up oil from the adjacent deposit. When this occurs, drilling the second well becomes uneconomic. Since the milkshake has already been consumed by the first straw, adding the second straw does you no good.

As you can imagine, the closer you cram nearby wells together, the greater the potential for drainage. Or, if corporate executives assume they can pack future wells closer together, then they can systematically overestimate their future drilling inventory.

This mirage that can exist on paper… until you actually start drilling those future wells. That’s where we find ourselves today, with future shale inventories now getting marked down across the board, as the Wall Street Journal explains…

“Companies learned that newer wells drilled too closely to older ones often caused interference with the original wells’ oil production or caused new wells to perform worse than expected. They eventually spaced wells farther apart, cutting into estimates of how many they had left to drill.”

Looking ahead, that means dramatically less inventory, and thus less potential shale production growth. The days of 20% - 30% annual production increases are long gone. Take Pioneer Natural Resources as a prime example.

Like many of its peers, Pioneer grew oil production by as much as 27% per year during the shale boom years. But now, the company is capping future growth at 5%. The reason why all traces back to preserving inventory, as CEO Scott Sheffield recently explained…

“You just can’t keep growing 15% to 20% a year… You’ll drill up your inventories. Even the good companies.”

Pioneer is not an isolated example. The Wall Street Journal cites research from FLOW Partners, indicating that the top five shale companies would burn through their entire inventory within six years if they grew production by 15% per year. Data from Bernstein Research and Rystad Energy point towards similar conclusions.

The Bakken and Eagle Ford shales have already burned through their core inventory, with rigs down over 70% from the peak. Even at reduced drilling rates, analysts expect the top tier drilling locations in each basin will likely be exhausted within 5 - 6 years.

Rystad reports that the number of highly economic drilling locations across five major shale basins has been slashed from 68,000 in 2016 to less than 35,000 today. In other words..

The future potential of the shale patch has been cut by nearly half in the last five years alone.

The bottom line: things will look a lot different in the shale patch going forward. Hurdle rates on investment have gone up, and available inventories have gone down.

Setting the Stage for the Next Oil Supercycle

The last decade was a horrific one for energy investors. The shale revolution invited a record wave of cheap capital into the U.S. energy sector. As night follows day, the boom set the stage for the inevitable bust.

Now, the bust is setting the stage for the next oil supercycle.

Notice, I didn’t use the word boom. What we’re seeing today is the exact opposite of a boom - capital starvation in the energy sector. Neither investors nor shale executives have any appetite for aggressive investments into production growth. Cash flow and shareholder returns are the only game in town.

Meanwhile, depleted inventories mean most shale companies simply can’t return to yesterday’s 20-30% annual growth rates, even if they wanted to. Finally, the rise of ESG mandates only adds more pressure on the capital inflows into the sector.

Add it all up, and you can see what it’s night and day at $90 oil now versus 10 years ago.

We’re still in the early innings of the next oil supercycle.

If you enjoyed this article and would like to see more content like this, please subscribe and share: