Oil's Biggest Supply Crisis in Decades

Volatility is here to stay, but supply shock indicates higher prices ahead

Energy’s roller coaster ride continues…

Following a record six day oil rally from $90 to $130 per barrel, prices revisited mid-$90 territory last week, leaving shell shocked traders feeling a bit like this:

The correction briefly wiped out the entire risk premium created from Russia’s invasion of Ukraine, before prices stabilized and recovered to close back above $100:

Despite last week’s collapse in prices, little changed in terms of the growing supply risks in today’s oil market. In fact, last week the International Energy Agency (IEA) warned that the oil market faces “the biggest supply crisis in decades.”

Today, I’ll review the latest supply and demand trends that indicate continued market tightness and higher prices ahead. But first, let’s examine the key factor driving today’s extreme price swings - the collapse in oil trading activity. We can see this in the collapse of open interest in futures contracts for both crude oil and refined products:

Commodity brokers boosting margin requirements has forced the traders who normally provide a volatility buffer to step away from the market. Anyone trading in these markets has likely noticed the lack of liquidity via price spreads blowing out. Whereas you might normally see a one or two penny spread between bid and ask in crude oil futures, spreads today are routinely $0.05 - $0.10 or wider.

That means we can expect the daily price movements to remain exaggerated - both up and down - going forward. However, if we look through this noise, the fundamental outlook for oil remains as bullish as ever.

Let’s start with the single biggest factor of all - the situation with Russian oil exports.

Even a Ceasefire Might Not Restore Russian Supply

The initial catalyst cited for last week’s oil price declines was news of diplomatic progress from Russian officials, citing the prospect of an imminent ceasefire in Ukraine:

With the benefit of hindsight, we now know that these reports were overly optimistic. Of course, from a humanitarian level - and for the sake of avoiding WW3 - we should all hope for an imminent ceasefire in Ukraine.

But it’s a big mistake for the market to assume a ceasefire means an immediate lifting of sanctions, and a return to business as usual for Russian energy. Given the scope of destruction Russia has inflicted upon Ukraine, the conflict has likely moved beyond the point of easy resolution. Entire cities have been leveled and over 10 million Ukrainian refugees have been forced from their homes. Plus, there are growing reports of Russia intentionally targeting Ukraine civilians.

At the very least, this means a long and difficult negotiation to achieve a lasting peace deal, even after a ceasefire is reached. Especially when you consider the escalating war of words and financial sanctions between Russia and the West. Just last Wednesday, US President Biden and Secretary of State Blinken both labeled Putin a “War Criminal” for Russia’s indiscriminate killing of innocent civilians. This was followed by similar claim from the Vice President of the European Commission Joseph Borrell:

These are serious claims, with serious implications. Reading between the lines, the odds are growing that Western sanctions could remain imposed on Russia indefinitely, even after a formal peace deal is reached with Ukraine. Consider this Wall Street Journal op-ed from former US assistant secretary of defense Bing West, which effectively calls for regime change in Russia by keeping sanctions in place for as long as Putin remains in power.

Given this backdrop, the reputational damage of doing business with Russia continues causing more Western companies to “self sanction” themselves out of the country. In the energy sector, it began with oil supermajors like Exxon, Shell and BP stopping exploration and development activity Russia. These moves will have a long-term impact on Russia’s ability to grow production, but little short-term impact.

However, things escalated further on Friday, when oilfield service giant Halliburton announced it would immediately end its business in Russia. Just one day later, both Schlumberger and Baker Hughes announced a halt to all further investment in Russia, which may set the stage for both companies pulling out of the country completely.

This is a big deal. Like many foreign oil producers, Russia relies on Western service companies for technology, spare parts and human capital to keep its oil and gas operations running efficiently. Russia can’t replace these services and spare parts overnight, which means a potential impairment to near term production.

Finally, there’s the most immediate threat to Russian exports - the simple refusal to buy Russian crude oil and refined products. So far, the volume of disruptions here have been rather minimal, as the deals signed weeks ago have continued working their way through the physical market. However, when the full effect of Western sanctions kick into gear next month, the market faces the prospect of a major disruption in Russian oil exports.

Russian Supply Losses Could Reach 3 - 4 Million Barrels per Day

The IEA, published its first official estimate of Russian supply losses last week… and it was a doozy. The agency calls for a massive 25% decline in Russian production starting in April. In other words…

An already-fragile global oil market could lose 3 million bbl/d starting next month.

The IEA report warned the market to brace for “oil’s biggest supply crisis in decades.” Meanwhile, famed commodities trader Pierre Andurand is calling for an even bigger supply hit. While making his case for $200 oil on the Odd Lots show, he estimated that Russian supplies could face a roughly 4 million bbl/d disruption. He also reiterated the point that an easy resolution in Ukraine remains unlikely:

“I don't think that suddenly they stop fighting, the oil comes back. It's not going to be the case. The oil’s going to be gone for good.”

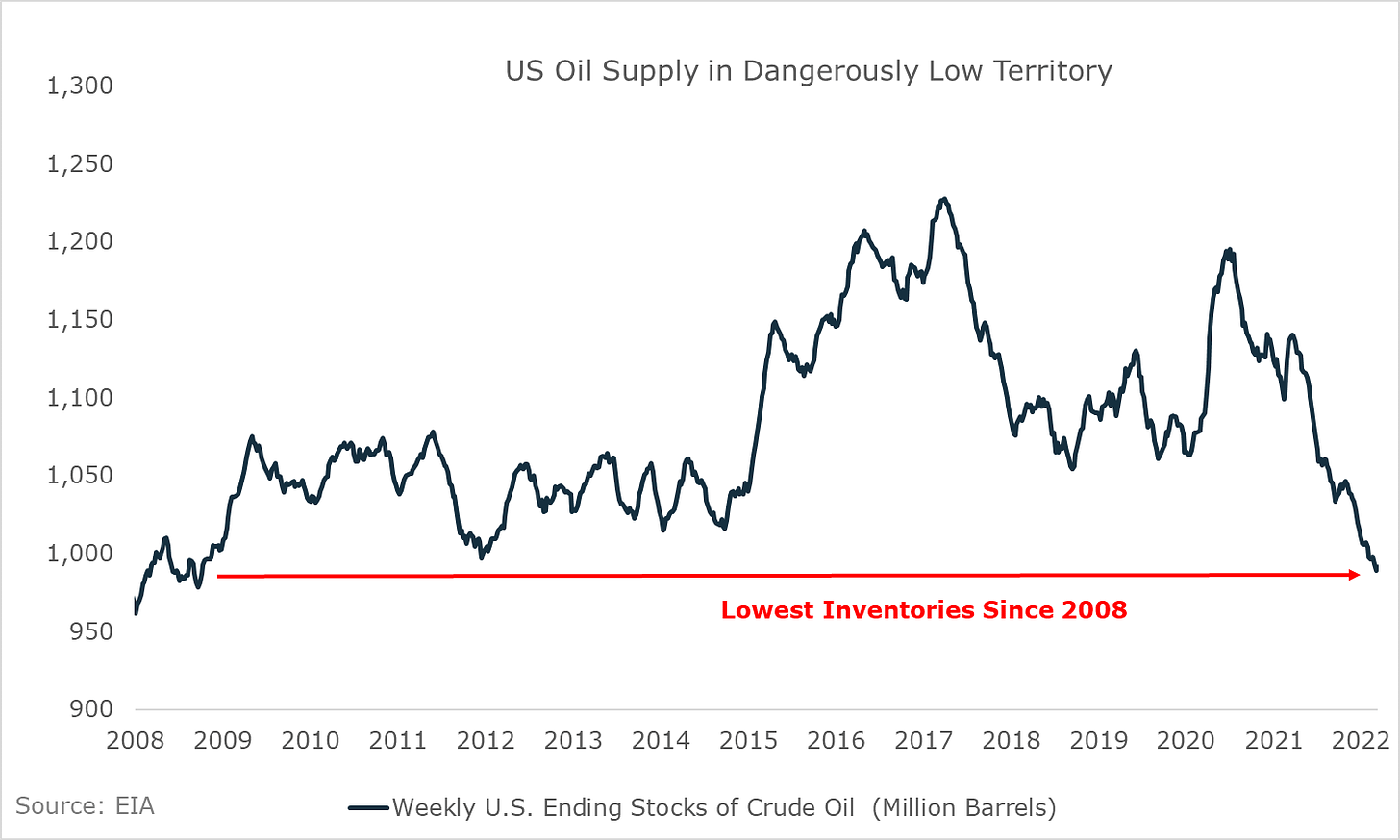

If either of these estimates are close to accurate, today’s bull market could quickly turn into an energy crisis. That’s because the latest inventory data shows that today’s oil market has no room to handle even a modest disruption, let alone losing 3 - 4 million bbl/d.

Global Oil Inventories at Dangerously Low Levels

In the IEA’s latest monthly data update, the agency reported a monstrous drawdown of 60 million barrels from global inventories in December. The early data for January showed a further drawdown of 13.5 million barrels, which puts global inventories at multi-decade lows.

For a more real-time view, we can examine the U.S. weekly inventory data. Over the last several weeks, U.S. oil stockpiles have dropped below 1 billion barrels to the lowest levels since 2008:

As a reminder, the last time oil inventories were this low, oil was on its way to $145 per barrel. And that was a garden variety bull market without a supply crisis. Within this context, $200 oil could end up being a conservative target.

Next, let’s consider the latest supply trends to see what the prospects might be for potentially filling in a 3 - 4 million bbl/d supply hole.

OPEC Production Struggles Continue

The IEA’s latest monthly oil report identifies the key factor driving down global inventories over the last year - the “chronic OPEC+ under-performance versus targets that has taken 300 million barrels of oil off the market since the start of 2021.”

As I’ve written about in the past, many OPEC+ members are struggling with the same headwinds facing U.S. shale output: underinvestment. This is a long-term problem that continues showing up with each monthly data point.

In the latest OPEC production report published last week, the group once again undershot its production quota by over 600,000 bbl/d. This is due to ongoing production struggles in periphery OPEC+ member countries, including Angola and Nigeria, among others.

The only two OPEC+ members with meaningful spare capacity are Saudi Arabia and the UAE. No one knows exactly what the spare capacity numbers are, but the consensus estimates range from 2.5 - 3 million bbl/d in combined output for both countries. So theoretically, if both Saudi Arabia and the UAE opened up the taps, they might come close to offsetting Russian supply losses.

Can Saudi Arabia and UAE Prevent a Global Energy Crisis?

Given the dire oil supply situation, politicians across the U.S., Europe and Japan are scrambling to convince both Saudi Arabia and UAE to unleash their spare capacity onto the market. But there are several challenges here.

First, this would involve breaking the current OPEC+ coalition, as both countries would exceed their agreed upon production quotas. Of course, anything is possible - particularly in a full blown energy crisis. But as things stand today, there’s little indication that either country intends to break the current OPEC+ agreement.

Complicating matters is the growing rift between the White House and both Saudi Arabia and the UAE. This can be traced to President Biden backing away from supporting each country’s involvement in Yemen’s ongoing civil war. The rift was best captured by the news that neither Saudi Arabia nor UAE officials responded to Biden’s phone calls during the initial Russian invasion of Ukraine. Meanwhile, Biden’s softening stance on key regional rival Iran isn’t helping matters (more on this next).

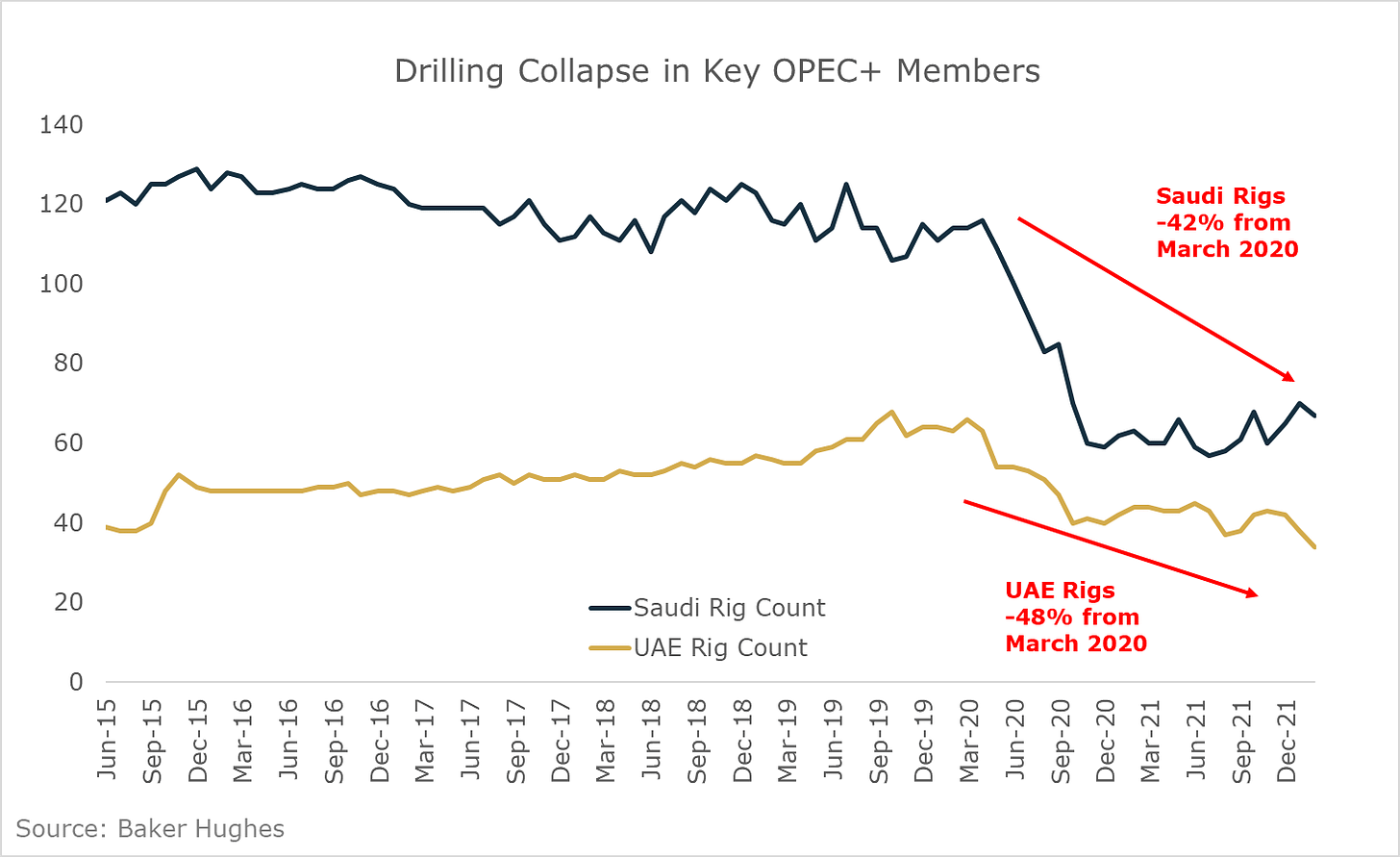

The second problem is shown in the chart below - a collapse in drilling activity in both Saudi Arabia and the UAE to nearly 50% below pre-COVID levels:

In order to fully unleash their full production capacity, it’s likely that both countries would need to boost drilling activity. So even if a decision is made to max out production, it could take 6 - 12 months to fully ramp output.

Finally, there’s the fact that both countries producing flat out would erase virtually all spare capacity from the global oil market. Without this critical supply buffer, traders would likely build in an ongoing supply risk premium that keeps prices elevated. In that case, the extra output from Saudi and UAE could become self-defeating.

Given these headwinds, it’s no surprise why the Biden administration is scouring the globe for any extra barrels they can get their hands on - including Iran and Venezuela.

US-Iran Deal Appears Imminent, Providing Near Term Supply Relief

U.S. sanctions on both Iran and Venezuela have kept oil production running below capacity in each country. The Biden administration is aggressively pursuing negotiations with both countries to potentially lift sanctions to unleash this potential production onto market.

By far, Iran is the best bet here - with roughly 1 million bbl/d in incremental new supply that could come online within 6 - 12 months. Iran also has about 100 million barrels of oil in storage ready for immediate sale if sanctions get lifted. Recent reports indicate substantial progress on Iran negotiations, suggesting growing potential for an imminent deal in the coming days.

The immediate release of 100 million stored barrels could provide some near-term relief to the market. But longer-term, the additional Iranian production won’t fully offset the disrupted Russian barrels. Meanwhile, lifting sanctions on Iran is a big concern to regional rivals Saudi Arabia and the UAE.

That means a successful deal with Iran might end up reducing the odds of getting more barrels from the two largest sources of global spare capacity.

Meanwhile, potential relief from Venezuela looks a lot less promising. The country’s oil industry is in total shambles after years of dysfunction. Even if sanctions got lifted tomorrow, Venezuela would struggle to add a few hundred thousand bbl/d over the next 12 months. Over a long time horizon, Venezuela could become a meaningful part of the global supply solution… but this is not a game changer in the near term.

That leaves one remaining source of meaningful supply growth - U.S. shale.

Shale Supply Continues Struggling

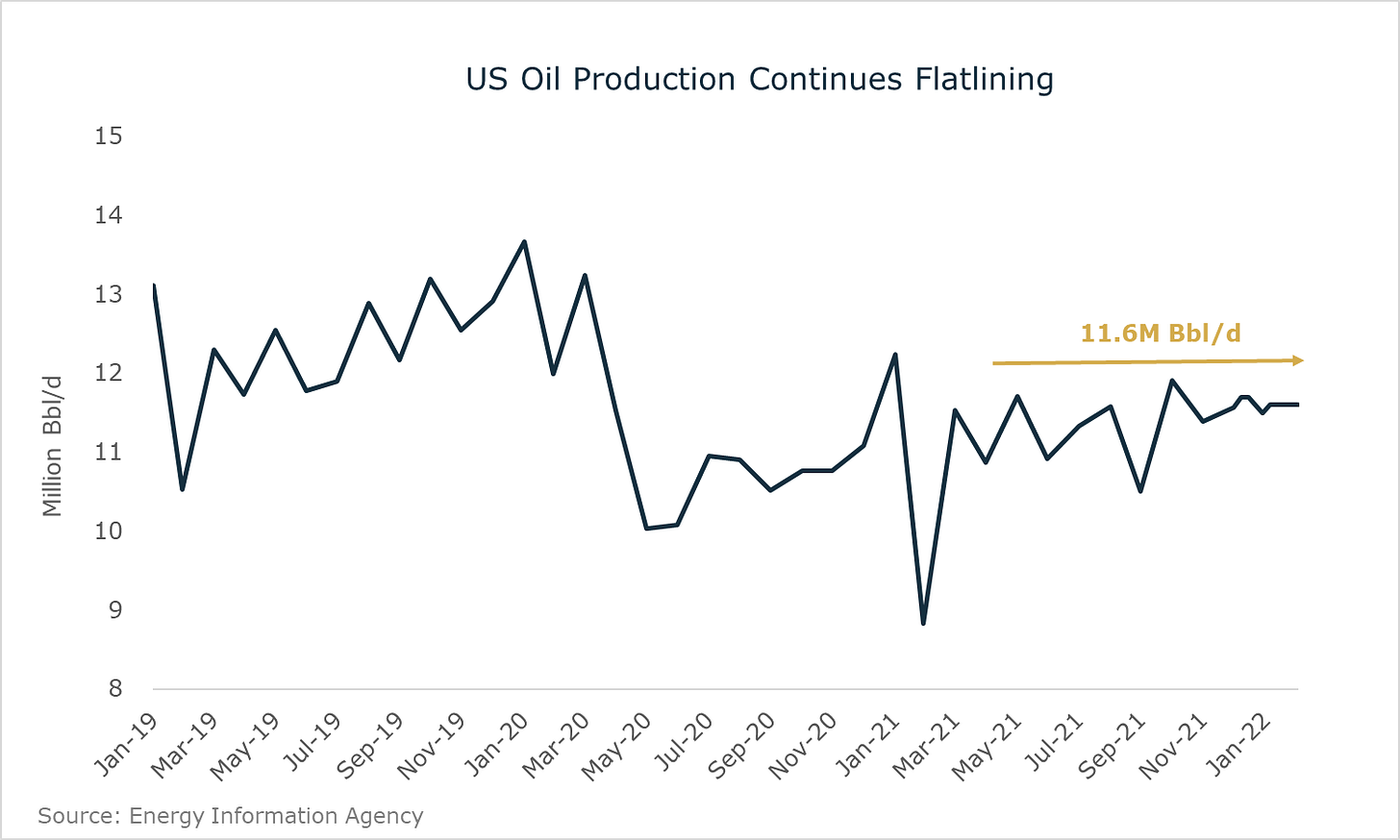

The latest weekly data from the EIA shows that U.S. oil production remains stalled out at 11.6 million bbl/d:

This number should move higher in the coming months. Current estimates range from about 600,000 to 1,000,000 bbl/d in U.S. output growth by year-end.

However, capital and supply chain constraints could present an ongoing headwind that keeps shale growth tilted towards the low end of estimates, even despite the returns available at $100+ oil. We can see this in the rig count data, including last week when U.S. drillers dropped 3 rigs from circulation. The total count remains 23% below pre-COVID levels:

Finally, let’s consider the latest trends on the demand side of the equation.

China Lockdown Worries Overblown

A resurgence in COVID-19 in China created another negative catalyst for crude prices last week. Reports surfaced early in the week that Chinese authorities had locked down the city of Shenzhen - a huge population of 17.5 million - among several others. These lockdowns are part of the country’s “zero COVID” policy.

But context here is important. COVID flare ups and lockdowns are nothing new in China. The duration is typically measured in weeks, not months. By Friday, Chinese authorities had already allowed some factories and public transport to reopen. By Sunday, Global Times announced a successful “controlling” of COVID cases and a return to normal in Shenzhen:

This is the key demand story of 2022 - a world increasingly moving beyond COVID restrictions and lockdowns. Even in countries with the strictest anti-COVID measures, like China, the duration and length of lockdowns seem to be growing shorter with each outbreak.

That’s why most forecasting agencies like the EIA continue calling for a rebound to new record highs in demand by 2022. Of course, if prices continue spiraling upwards, demand destruction becomes a real concern.

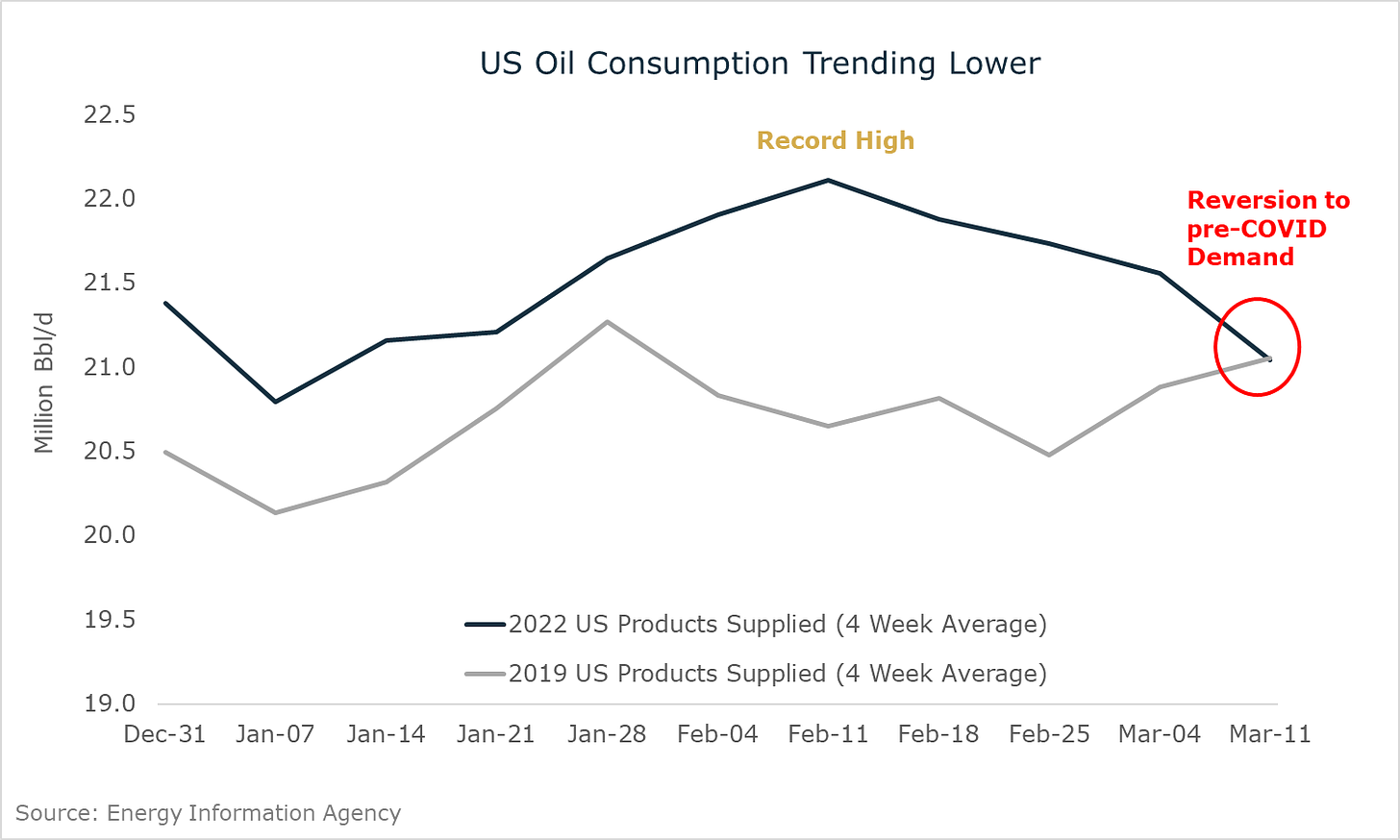

That’s why monitoring the high frequency demand data will become increasingly important in the weeks and months ahead. The latest weekly consumption data in the U.S. reveals a modest softening trend, reversing from the record highs reached in early February down to 2019’s pre-COVID levels:

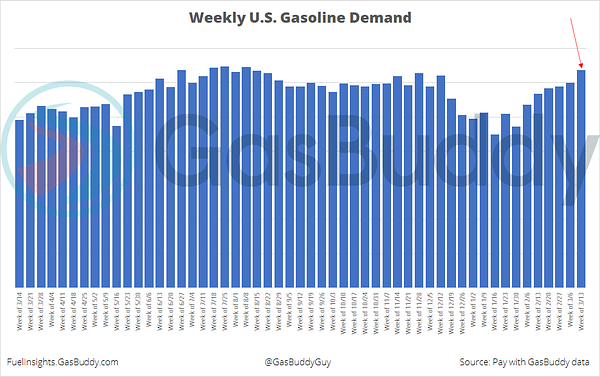

The jury is out on whether this is a temporary blip or the start of a new trend. However, early indications from higher frequency data provide reason for optimism. Patrick De Haan of GasBuddy collects some of the best high frequency data on U.S. gasoline demand, and his latest numbers show that American drivers aren’t retreating from higher prices just yet:

We’re also seeing a big demand resurgence in U.S. air travel.

Record Air Travel Demand - the Next Upside Catalyst?

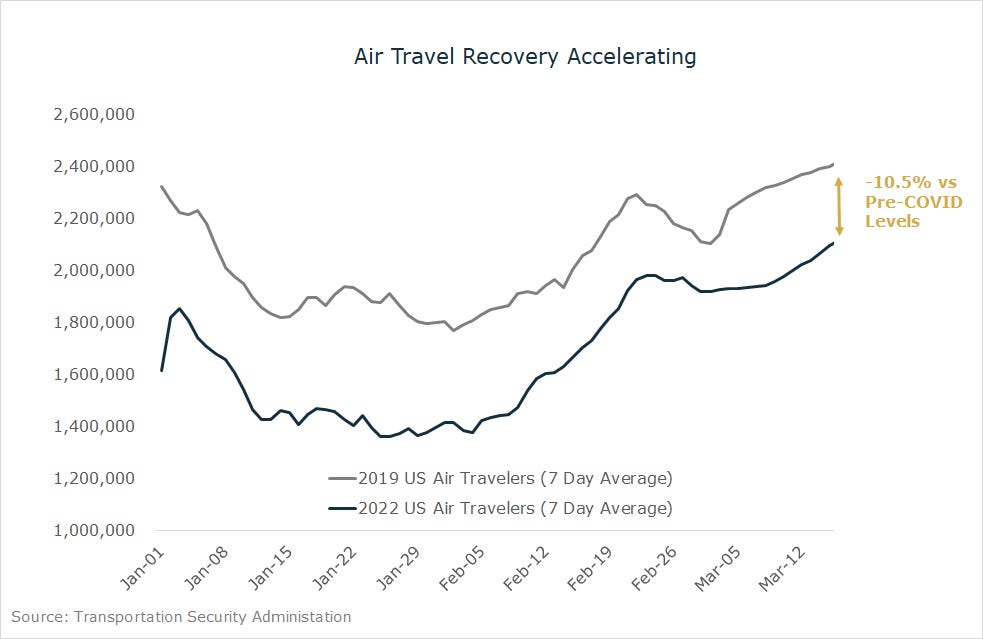

The latest daily travel data from the TSA shows a big boost over the last week, narrowing the deficit versus pre-COVID levels from -15% to -10.5%:

Meanwhile, Reuters reported last week that Delta Air Lines observed an “unparalleled” jump in demand, with the highest weekly ticket sales in the company’s history. Delta CEO Ed Basian claimed that “we’ve not seen a stronger demand in my career”. United Airlines and American Airlines each also reported record demand.

These latest trends in both gasoline consumption and air travel indicate that demand destruction hasn’t kicked in yet. If anything, we could be on the verge of new record highs in consumption going forward.

Don’t Count Out this Bull Market Just Yet

Despite the short-term price volatility, the oil supply/demand backdrop remains as bullish as ever. Recent inventory data shows a dangerously tight market, even before the full impact of Russian supply losses.

If the IEA’s estimates prove accurate Russia loses 3 million bbl/d starting next month, the market could soon transition from merely tight into a crippling shortage. In order to meet this year’s growing demand plus offset 3 - 4 million bbl/d of lost Russian supply, we need need a trifecta of good fortune including:

1) a successful Iran deal,

2) Saudi and UAE breaking ranks with OPEC+, and

3) US shale kicking into high gear.

But even in this goldilocks scenario, the market would be still be running on fumes in terms of spare capacity.

So while we can count on continued volatility, I wouldn’t count out this bull market just yet.

Another outstanding article Ross!

Nice article. Does it means that it is bullish for energy equities and sector rotation from energy to others is not going to happen this year? Thanks