How to Turn $10k into $50 Billion: A Classic American Success Story

Earn a tax-advantaged, inflation-protected 9% yield from this world class business, with upside to 20 - 30% compounded returns

At just seven years old, Dan Duncan’s life took a tragic turn…

The year was 1940, and Dan was growing up in Shelby County - a small farm town in East Texas. Farm life during the Depression was tough enough… but things got much harder when Dan’s younger brother died of blood poisoning. Three months later, Dan lost his mother to Tuberculosis. Then, his father moved away to find new work opportunities.

In the span of less than 12 months, the seven year old’s life was completely uprooted.

Dan went to live with his grandmother, and that’s when he changed the script of his life story. She inspired in him a sense of drive to overcome his early-life struggles and setbacks. Her attitude was best captured by her common refrain: “do the best you can every day.”

Dan Duncan’s story is a testament to the power of persistence. He turned the tragedy of his early life challenges into a forging fire of grit and character, enabling him to found one of America’s most successful businesses, and one which continues thriving to this day.

From Tragedy to Triumph

After working for an oil pipeline company for 10 years and saving up seed capital, Duncan ventured off on his own in 1968. With just $10,000 and two propane delivery trucks, he founded what would become Enterprise Product Partners (EPD).

Over the next 30 years, Duncan grew Enterprise into one of America’s largest oil and gas midstream companies - the businesses tasked with moving energy from upstream producers to downstream consumers (i.e. oil drillers to refineries).

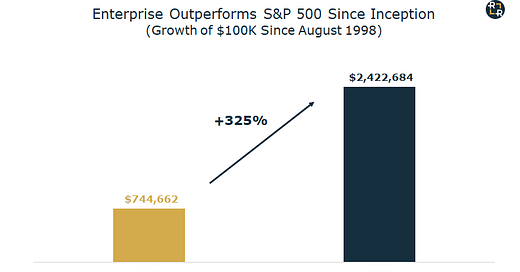

Enterprise went public in 1998, and that was just the beginning. Over the next two decades, Enterprise created billions of dollars in wealth for investors, and handily outperformed the stock market:

By the time Ducan passed on in 2010, he had transformed his original $10,000 into an asset base approaching $50 billion. The best part? He did it all with no privilege or pedigree - a true American rags to riches success story.

The business he built continues rewarding investors to this day.

In this article, I’ll explain how Enterprise has established a world-class collection of assets, a wide competitive moat, and why it’s poised to continue rewarding investors with outperformance for years to come.

But first, you should know that Enterprise Product Partners is different from most regular corporate stocks you might buy. The business is structured as a master limited partnership (MLP), which means you buy “units” instead of shares, and receive “distributions” instead of dividends. When you buy into an MLP, you are considered a limited partner in a business managed by the general partner.

This unique business structure creates some excellent tax benefits, but also potential complications you should be aware of. (Note: every individual investor has a unique tax situation, and you should always perform your own research and due diligence when making tax and investing decisions. I’m not a licensed professional, and this is general information only. Consult with a tax professional for tax advice, and an investment professional for investment advice. Click here to find a good overview of the benefits and potential complications of MLP investing.)

Let’s quickly review the highlights…

Key Tax Advantages of MLP Investing

MLPs are considered “pass-through” entities, which means they pass through cash flows and tax liabilities to their limited partner investors. That means at tax time, you’ll receive a K-1 form instead of the more common 1099 form for stock dividends. While K-1s are a bit more complicated than 1099s, most tax software programs are set up to process these forms in a matter of minutes these days.

The upside here is that MLPs enjoy preferential tax treatment at both the corporate and unitholder level. At the corporate level, accelerated depreciation rules allow MLPs to take large depreciation expenses against their net income, thereby keeping their corporate taxes low. This means the key financial metrics for measuring the business performance of MLPs are found in the cash flow statement (more on this later).

By design, MLPs distribute all of their available cash flows back to investors, as noted in the Enterprise SEC filings:

“Our partnership agreement requires us to make quarterly distributions to our unitholders of all available cash, after any cash reserves established by Enterprise GP in its sole discretion.”

This commitment towards cash flow distribution explains why MLPs typically sport some of the juiciest yields in the stock market - including Enterprise’s current 8.5% yield.

Even better, MLP distributions come with substantial tax benefits. Unlike stock dividends, which come with a tax bill in the year you receive them, MLP distributions don’t get taxed until you either a) sell your units, or b) your cost basis falls below zero.

For example, let’s say you invest $100,000 into an MLP that pays out a flat $10,000 per year in distributions. You could theoretically hold this position for up to 10 years and collect $100,000 in income before paying any taxes.

In today’s world of ever-rising tax rates, this can become a tremendous boost to your bottom line as an investor - especially for those who reinvest distributions over time and enjoy tax-deferred compounding.

As you’ll see in today’s article, I believe the stage is set for a substantial increase in Enterprise’s distribution in 2022 and beyond. Between my expectations for yield growth and capital appreciation, I’ll make the case for why Enterprise units could deliver a relatively low-risk 15% compounded return going forward, with upside potential to 20% - 30%, all while paying you a juicy yield to wait.

Let’s begin by exploring the company’s single biggest competitive advantage…

The Enterprise Advantage: A Culture of Ownership

When Enterprise founder Dan Duncan passed on in 2010, his 32% stake in the company was transferred to each of his four children, equally. They own these units through the Duncan family Trust. One of the four children is actively involved in the company’s management - Randa Williams, who currently serves as Chairman of the Board.

Randa Williams has been actively involved with the company for nearly three decades, including occupying various senior management positions since 1994. She has proven herself to be a great steward of capital and in guiding the strategic direction for the company.

Meanwhile, the rest of the senior management team contains a long list of tenured executives who sport an equally impressive track record running the business, who all have skin in the game. Part of Enterprise's corporate governance policy requires insiders to own an amount of the company's units worth at least 3x their annual salary.

Between the Duncan Trust and other executives and directors, insiders own a combined 32.5% of the outstanding Enterprise units:

I don't know of many other public energy companies with such a high percentage of insider ownership. But I do know that this culture of insider ownership could have prevented a lot of capital destruction over the last decade. Let me explain…

You see, the shale boom era was a poster child of flawed corporate incentives. Executive compensation packages were often tied to top line growth, whatever the cost. The inevitable result - too much capital spent chasing marginal projects.

When economic reality collided with stock prices, shareholders paid the price. Meanwhile, executive option packages simply got reset at lower strike prices the following year, allowing insiders to continue cashing out, regardless of the business results.

In a nutshell, that’s how corporate insiders got rich during the shale boom, even as public shareholders lost billions. As the great Charlie Munger explains…

Show me the incentive and I'll show you the outcome.

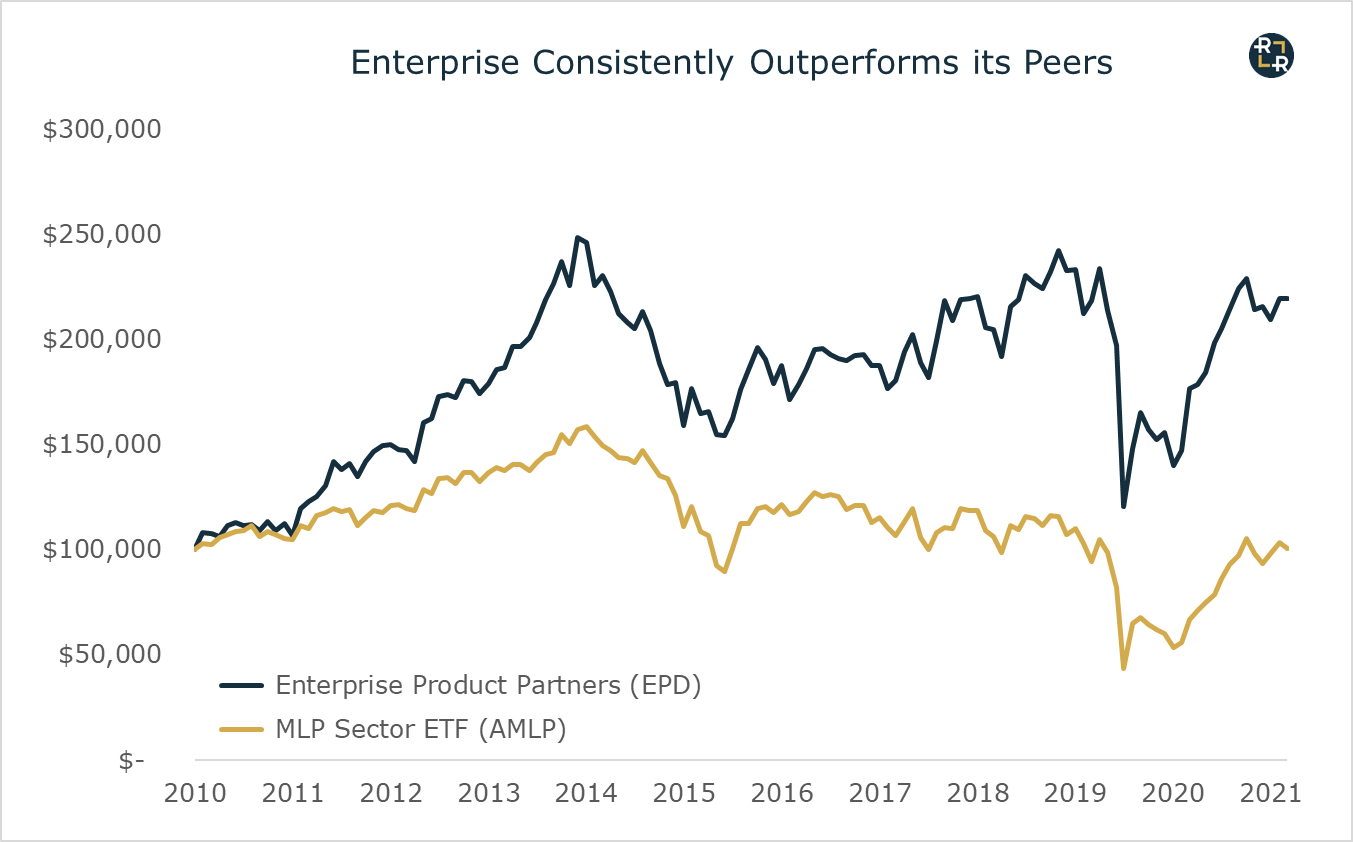

When you compare the different incentives at work here, you can understand the source of the divergent outcomes between Enterprise versus a basket of its peers, as measured by the Alerian MLP exchange traded fund (AMLP):

The advantage Enterprise enjoyed from this culture of ownership has trickled down into its asset base over time. But before getting into the details, let’s first examine how Enterprise makes its money.

The Midstream Business: More Broker than Toll Road

Investors often describe midstream companies as the “toll roads” of the energy market. But that’s not quite right. Midstream companies act much more like energy brokers. Let me explain…

You see, in the toll road analogy, an upstream producer like EOG would contract oil sales with a downstream consumer, like an oil refiner on the Gulf Coast. The two companies would then pay Enterprise to move the oil from buyer to seller. Here’s the problem with this toll road approach...

What if the refinery shuts down operations for maintenance? EOG must then either shut in production, find storage, or find another buyer on the spot. Conversely, what if EOG suffers a production issue that curtails supply? Each company would rather avoid these risks and headaches.

Midstream businesses solve these problems. Companies like Enterprise purchase oil and gas directly at the wellhead, and then handle the processing, storing, transport and marketing to the final customer. Upstream producers like EOG happily pay for the convenience of selling at the wellhead, so they can continue focusing on what they do best - drilling more oil wells.

In exchange for this convenience, companies like EOG sell oil and gas to Enterprise at a discount to current market rates. That’s how Enterprise makes money: buying upstream at a discount and selling downstream, earning the spread in between.

So now you can see why Enterprise acts a lot more like your stock broker rather than your toll road operator. And in the same way that your stock broker doesn’t care about stock prices, Enterprise doesn’t care about oil and gas prices - the company earns a fixed spread between the bid and ask.

This business model enjoys remarkable stability in profit margins and cash flows, despite the cyclicality and volatility of energy prices. You can see this in the chart below, showing the stable spread between Enterprise’s revenue and cost of revenue:

Consider an example of how this might work. Let’s say oil prices drop from $80 to $40, which cuts Enterprise’s oil revenues in half. However, when Enterprise buys oil, it now costs half as much. So instead of buying oil upstream for $79 and selling downstream for $80, Enterprise now buys at $39 and sells for $40.

The bottom line: the business still earns the same $1 spread, regardless of where energy prices trade.

Enterprise also locks in cash flow stability by structuring “take or pay” deals with buyers - where the contracted buyer still pays Enterprise a fee even when the buyer doesn’t need the energy. That’s another way Enterprise maintains stable cash flows, even when energy prices and/or volumes fall during cyclical downturns. We can see this in the company’s cash flow history, including remarkable stability during each of the last two energy bear markets, as shown below:

So, even though midstream stocks often trade with a tight correlation to the exploration and production (E&P) sector, the two businesses couldn’t be more different.

E&Ps not only have high fixed costs, but their cash flows are often directly exposed to commodity prices. So when prices crash, E&P cash flows can take a huge hit, forcing management teams to slash investment budgets and shareholder return programs.

Enterprise, on the other hand, enjoys a business model that continues rewarding investors through the booms and busts - with an incredible track record of 23 consecutive years of distribution increases:

This track record not only separates Enterprise from the broader energy sector, but the company also exists in a league of its own among fellow midstream operators. I don’t believe any other oil and gas midstream company can claim 23 consecutive years of distribution increases.

So, Enterprise’s operating results are not simply the result of the macro forces in the general midstream sector. There’s something unique about its particular business that lends it a competitive advantage over its beers.

We’ve already discussed the advantage Enterprise enjoys from its unique culture of ownership, which incentivizes management to make prudent capital allocation decisions. Over the decades, this advantage has compounded on itself, resulting in a dominant asset base that reflects a competitive advantage in and of itself.

Enterprise’s Network Advantage

In the business of energy brokering, your network is everything. And by network, I mean the physical infrastructure for processing, storing and moving energy.

With $64 billion in midstream assets, Enterprise owns one of the largest midstream networks in North America. This includes over 50,000 miles of pipelines, 260 million barrels of storage capacity for petroleum liquids and 14 billion cubic feet of natural gas storage. The company also owns a combined 45 processing plants for natural gas and natural gas liquids (NGLs).

The map below shows how Enterprise connects the prolific shale oil and gas deposits in the Permian and Eagle Ford right into the heart of America’s vast petrochemical and shipping complex along the Gulf Coast:

More important than the size of Enterprise’s asset base, is the strategic location and interconnectedness that creates synergies and economies of scale. The end result: Enterprise can often provide customers with greater flexibility, faster product deliveries and lower costs versus its lesser-scaled competitors. Consider an example...

Not all crude oil is created equal. Different crude characteristics, including density and sulfur content, require different refineries for processing.

Enterprise solves this problem with its massive crude oil terminal network, which can store over 40 million barrels per day - or more than three times total U.S. daily production volume. This includes the ECHO terminal located in Midland, Texas - right in the heart of the Permian basin. The ECHO system can gather and transport multiple grades of crude oil, ranging from the light, sweet variety to sour crude and condensate.

These massive ECHO storage facilities are connected via pipeline to every refinery in Houston, Texas City, Beaumont and Port Arthur, Texas. In total, Enterprise’s terminal network links up to 8 million barrels per day of refining capacity - or nearly half of total U.S. refining capacity.

As market conditions shift, shortages or surpluses of different crude grades emerge over time. Enterprise addresses these imbalances through its vast network of storage facilities - including vast connections to both upstream producers and downstream consumers - solving imbalances and capitalizing on arbitrage opportunities that arise.

Enterprise also capitalizes on macro-driven trends in energy prices. As an example, when spot oil prices trade for less than futures prices (i.e. contango), Enterprise can make money from simply buying and storing oil, and then selling for higher prices down the road.

That’s precisely what the company did in the Spring of 2020, when spot crude prices crashed by the most on record - briefly falling into negative territory. Even after prices rebounded, the market remained in a state of extreme contango for months - allowing Enterprise to profit even when most other energy companies were burning cash.

And that’s just on the oil side of the business. The truth is, Enterprise’s real opportunity lies in a lesser followed section of the energy market: natural gas liquids, which makes up half of Enterprise’s business versus just 24% for crude oil:

Given the macro supply/demand trends for U.S. NGLs, you’ll see why Enterprise likely enjoys a long runway of growth ahead.

U.S. Natural Gas Liquids: a Growth Market

Let’s start with a quick overview of NGLs…

NGLs are the heavier gas molecules often produced alongside dry natural gas (methane) and/or oil. These molecules include things like ethane, propane and butane among others. Unlike the single-carbon methane molecule, NGLs include multiple carbons (2 for ethane, 3 for propane, 4 for butane, etc.). This larger molecule size means two things:

NGLs condense more easily into liquids, hence the name “natural gas liquids”, and

More carbon bonds mean greater utility for a wide variety of chemical reactions.

This second property explains why NGLs are primarily used as feedstocks for a variety of petrochemicals, including ethylene (used for making plastics), fertilizers, solvents, lubricants and countless industrial and consumer products.

Even as the world increasingly moves towards things like wind and solar power, NGLs will continue being consumed as raw materials for the critical products used in everyday life around the globe. After all, you can’t make plastic or lubricate machinery with wind power (in fact, windmill turbines consume huge quantities of hydrocarbon-based lubricants).

That’s great news for America, where the shale boom has unlocked the largest source of low-cost NGLs in the world. Much fanfare has been made of America’s booming dry natural gas exports, via liquefied natural gas (LNG). However, there’s an even bigger and largely untold story in the dramatic rise of U.S. NGL exports:

The fundamental story here involves the same driving force fueling America’s surging LNG exports - the arbitrage between dirt cheap shale gas and NGLs versus much higher prices overseas.

Even after factoring in the added cost of liquefying and shipping gas abroad, U.S. LNG and NGL exports offer a cost-advantage over many alternative sources around the globe. This price arbitrage supports a multi-year, potentially multi-decade trend of U.S. continuing to take market from the higher-cost energy sources around the world.

Meanwhile, in the same way that cheap natural gas has inspired a surge in U.S. gas-fired power plants, cheap NGLs have encouraged an explosion of new U.S. petrochemical plants who consume NGLs as feedstock. Between growing domestic demand and surging export volumes, the need for U.S. NGL production and transport shows no signs of slowing anytime soon.

Consider the case of ethane, the key input for ethylene crackers, which produce the feedstock for plastic-makers. Based on estimates from the U.S. energy information agency (EIA), U.S. ethane production is expected to surge from 1.85 million barrels per day in 2021 to as high as 2.6 million b/d by year-end 2022. The agency also expects U.S. ethane exports will grow by more than 50% from 300,000 in 2021 to 460,000 b/d by the end of next year.

That’s great news for Enterprise, which has established itself as one of the most dominant, highly scaled businesses for processing and transporting U.S. NGLs like ethane.

Enterprise’s Dominant NGL Network

Perhaps the crown jewel of Enterprise’s NGL export infrastructure is the Enterprise Hydrocarbons Terminal (EHT) - a massive, waterfront export terminal located in the Houston Ship Channel. The terminal contains seven deep-water docks that can accommodate ships with up to a 45 foot drag - including Suezmax tankers, the largest tanker vessels able to pass through the Houston Ship Channel. This confers Enterprise with a key competitive advantage, as the company explains in their SEC filings:

“We believe that our location on the Houston Ship Channel enables us to handle larger vessels than our competitors because our waterfront has fewer draft and beam (width) restrictions.”

The company explains how the unmatched scale of EHT allows Enterprise customers to enjoy “greater efficiencies and cost savings”. This includes a maximum loading capacity for liquefied petroleum gas of 835,000 barrels per day, and up to six Very Large Gas Carrier vessels. EHT also provides operational flexibility for rapid switching between loading propane or butane for export.

In addition to EHT, Enterprise owns the Morgan Point Ethane Export Terminal - the largest refrigerated ethane export facility in the world, capable of loading 10,000 barrels of refrigerated ethane per hour. Located in the Houston Ship Channel, the Morgan Point Ethane Terminal provides a sales outlet to international markets.

Each of these export terminals sources NGL supplies from Enterprise’s massive NGL storage and fractionator complex in Mont Belvieu, Texas. Enterprise’s Mont Belvieu footprint includes 130 million barrels of NGL storage capacity, plus over one million barrels per day of NGL fractionation capacity - representing about 40% of total U.S. daily NGL export volumes.

These fractionating facilities are critical when dealing with NGLs, because most wellhead oil and gas streams contain a mixture of different NGLs. Fractionators use a series of boilers to separate these different compounds from one another, based on the idea that different NGLs boil and condense at different temperatures. This allows Enterprise to convert wellhead gas into pure product streams.

By controlling every part of the midstream value chain, from the wellhead to the final customer, Enterprise’s fully integrated business model allows for efficient matching of NGL supply and demand.

The bottom line: Enterprise has established a dominant NGL position, by investing heavily in a large scale network of assets which create unmatched economies of scale, resulting in lower costs and more efficient processing times for its customers. The proof is in the pudding - with Enterprise’s NGL profits up more than 140% since the start of the shale boom in 2010:

This also provides a clear answer to the biggest complaint I get when talking Enterprise with other investors, which is: who wants to own an oil pipeline company in the age of electric vehicles and renewable energy?

While I personally believe oil has several decades of runway as a major global fuel source, that’s besides the point here. Enterprise is mostly a natural gas and NGL company, with only a minority of its profits coming from crude oil.

And since America’s U.S. NGL boom shows no signs of slowing anytime soon, Enterprise has a long runway of profitable growth opportunities ahead.

That brings us to the key question at hand…

What Kind of Returns Can Enterprise Investors Expect?

Since Enterprise distributes all of its available cash flows to investors, modeling the expected forward returns distills down into three simple components:

Enterprise forward returns = current yield + yield growth rate + change in valuation

Of course, simple doesn’t mean easy. The challenge here lies in anticipating the future growth rate of Enterprise’s cash flows, which will determine its future yield trajectory.

As noted previously, the company sports an incredible long term track record of distribution growth. But in the shorter term, the chart below reveals a deceleration from a prior range of 5-8% annual distribution increases down to about 2% over the past five years:

On the surface, this might seem like a sign of weakness in the underlying business. But a closer examination reveals the opposite - the recent slowdown in distribution growth has bolstered the business and put it into a position of great strength today.

Enterprise Becomes a Self-Funded Business

Recall from earlier that MLPs are committed to distributing their “available cash flows” back to investors. The nuance here lies in the term “available” - which means cash leftover after satisfying the capital needs of the business.

The two key sources of Enterprise’s discretionary cash consumption include funding growth projects and shoring up the balance sheet. In the case of Enterprise, management made a deliberate decision to slow the distribution growth rate in order to begin self-funding the business with internal cash flow, as co-CEO Randy Fowler explained on the company’s recent Q3 earnings call:

“We shifted our posture in 2017 to be able to finance the business better rather than relying on both the debt and equity capital markets. I think we were the first mover in coming in and self-financing the business.”

We can see clear evidence of this shift in capital strategy in the financials. Before 2017, Enterprise funded growth with a steady issuance of new equity and debt. But starting in 2017, new equity issuance dropped to zero - with outstanding units virtually flat since then.

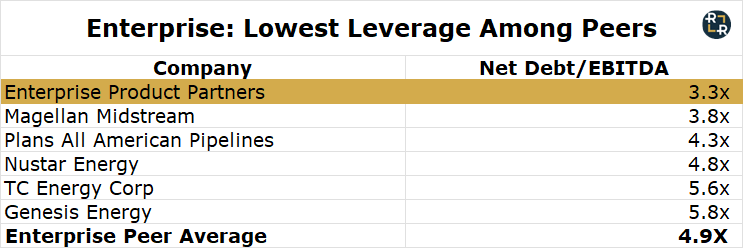

Meanwhile, debt has increased a modest 13% from $24.6 billion in 2017 to 27.7 billion today. Over the same time period, operating cash flows grew by over 50% from $5.2B to $7.9B. So despite the modest growth in absolute debt, leverage as a percentage of operating cash flows has come way down - to just 3.3x on an adjusted basis.

So Enterprise not only self-financed a 50% increase in operating cash flows since 2017, but it also cut down its leverage ratio - giving enterprise the cleanest balance sheet among its peers, and a full 1.6 turns below average:

This puts Enterprise in a great spot going forward - it now enjoys the option of either increasing investor payouts, or flexing its balance sheet for growth opportunities.

Within this context, we can begin thinking about cash flow growth going forward.

Enterprise’s Cash Flow Trajectory

As mentioned earlier, the focus for MLP performance lies not in the income statement - which gets weighed down by high depreciation costs - but rather in the cash flow statement. Specifically, the key operational metric is known as “Distributable Cash Flow (DCF).”

Enterprise calculates DCF by subtracting non-cash items from net income, including changes in derivative values and gains in equity value from unconsolidated affiliates. The calculation also adds back non-cash depletion expense, while subtracting out maintenance capital expenditures.

The end result: a measure of the cash flows available for distribution to investors, after factoring in cash costs required to maintain the existing business, as Enterprise notes in its SEC filings:

“Specifically, this financial measure (DCF) indicates to investors whether or not we are generating cash flows at a level that can sustain our declared quarterly cash distributions.”

The table below shows the company’s DCF growth since 2017, including how much DCF was retained internally versus distributed back to unitholders:

Notice how Enterprise grew DCF at a rapid 10% compounded rate since 2017 - painting a much healthier picture of the core business versus the 2.2% growth in the cash distribution rate. In other words, the core business has done just fine since 2017 - management simply started retaining more cash versus paying it out to unitholders.

This has put Enterprise in great shape today, generating $1.70 in cash for every $1 in distributions paid out, reflecting a healthy 1.7x distribution coverage ratio.

Going forward, the return trajectory will depend on how much capital management decides to return to unitholders versus investing in growth projects. To get a sense of what that might look like, let’s first look back at historical capex trends and its relationship to DCF growth.

Enterprise’s Capex and Growth Trends

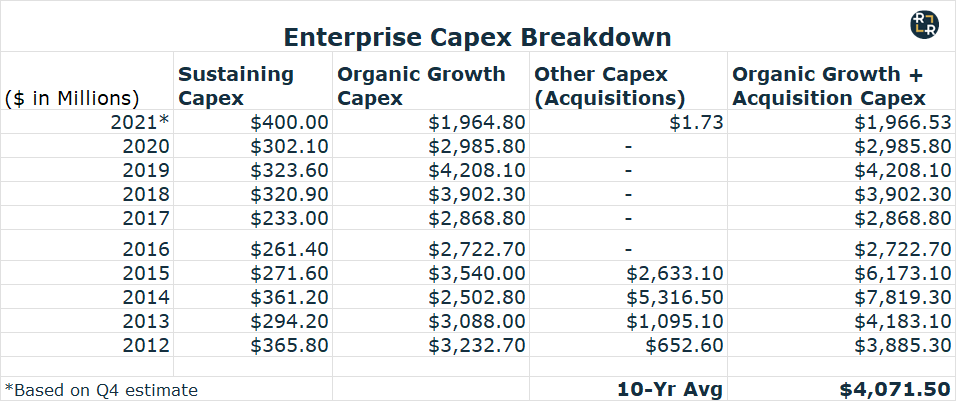

If we zoom out over the last 10 years, smoothing out the cyclical ups and downs, Enterprise has compounded DCF at 5.3% annually. Over the same time period, the company has averaged roughly $4.1 billion in annual growth capex, which I define as spending on organic growth projects plus acquisitions, shown below:

So, Enterprise averaged roughly $4.1 billion in annual growth capex (including acquisitions) to generate 5.3% compounded DCF growth over the last decade. As a crude approximation, that’s roughly 1.3% annual DCF growth per billion in growth capex.

Now, what should we expect going forward? As you can see in the chart above, 2021 reflected a significant step down in growth capex to just under $2 billion. Management is again taking growth capex down next year, to a range of $1 - $1.5 billion, per co-CEO Randy Fowler guidance on Enterprise’s Q3 earnings call:

“Shneur, as we sit here today on November 2, our best estimate for growth CapEx in 2022 is $1 billion to $1.5 billion.”

This implies one or two things going forward: either management will start sending a higher proportion of DCF back to unitholders, or they’re stockpiling cash for future acquisitions. We’ll revisit the acquisition angle shortly.

For now, let’s go down the first path and assume management plans to invest less in order to return more capital to unitholders. After all, that’s what management guided for on the company’s Q3 earnings, noting:

“Our first priority is supporting and growing distributions to investors.”

In the near term, that means we should expect a slowdown in DCF growth. Based on the historical capex and DCF trends, I expect a range of 1 - 2% DCF growth based on growth capex ranging from $1 - $1.5 billion.

However, the flip side is, more cash going back to unitholders. This scenario implies the inverse of the situation from 2017 - 2021 going forward - where DCF growth slows, but distribution growth increases.

Before crunching the numbers, there’s one final puzzle piece we must consider - the inflation component embedded into Enterprise’s DCF growth.

How Enterprise Can Provide an Inflation-Protected Income Stream

One of the great challenges for fixed income investors in today’s environment is the dreadful combination of rock bottom yields and spiking inflation. The latest government data shows U.S. consumer prices running a 6.9% - the highest levels of the last 40 years:

Here’s the good news: Enterprise not only offers a well-covered, above-average yield, but that yield comes with built-in inflation protection. That’s because Enterprise structures nearly all of its customer sales agreement to include an uplift in revenue tied to inflation, as management described on the company’s Q3 earnings call:

“On inflation, I want to say over 90% of our revenues have some sort of escalation mechanism in there, which are benchmarked to various indices.”

In the near term, this is great news for Enterprise. Why? Because the company has already sunk tens of billions of dollars into productive capital at yesterday’s prices. Now, investors can enjoy the uplift from inflation boosting the revenues they charge customers.

On the recent Enterprise Q3 earnings call, management hinted at a significant boost in the distribution given this tail-wind from higher inflation:

“As far as how we think about the distribution, we said -- really what we're trying to achieve is trying to keep to, what is it, purchase power parity. And so we would like to come in. And with the increased inflation, have an increase in the distribution growth rate compared to what you've seen over the last 3 or 4 years.”

Given that inflation has averaged 4.6% so far in 2021, and recently spiked up to nearly 7%, Enterprise investors could enjoy a mid-single digit increase in the distribution next year based on the uplift from inflation alone.

Now, we have the proper pieces in place to estimate a range of scenarios for Enterprise’s DCF, distribution rate and forward returns from here.

Forecasting Enterprise’s Future Returns

For 2022, I’m forecasting Enterprise will generate $6.7 billion in DCF, reflecting low single-digit growth versus 2021. That growth is based on three factors, including the ongoing recovery in oil and gas volumes, several growth projects recently or soon coming online, plus a modest uplift from inflation-linked rate hikes.

In terms of growth capex, I’m erring on the high end of management’s range with an assumption of $1.5 billion for 2022. Meanwhile, I also expect management will continue stockpiling cash in the range of $500 million to $1 billion. As you’ll see in the next section, that’s based on the view that management will potentially begin finding attractive acquisition targets going forward.

Adding it all up, and I’m penciling in a range of $2.0 - $2.5 billion in retained cash from the $6.7 billion in DCF for 2022. That leaves a distribution range of $4.2 billion - $4.7 billion, which translates into a yield on Enterprise units of between 9.2% - 10.2% based on a $21 unit price:

Next, returning back to the expected return equation…

Enterprise return estimate: current yield + yield growth rate + change in valuation

Based on the math described above, I believe investors can expect a 9.2% - 10.2% current yield in 2022, plus a growth rate of 2% assuming a constant $1.5 billion in growth capex going forward, plus ongoing increases linked to the inflation rate.

That pencils out to an expected range of 11.2% - 12.2% real return (i.e. inflation-neutral), plus or minus any changes in the valuation of Enterprise units from here.

But note the key assumption so far - that Enterprise will only invest $1.5 billion annually going forward. As you’ll see, this critical assumption may turn out to be overly cautious.

To understand why, let’s first address the valuation component of the forward return expectations.

Enterprise Trades at Crisis-Level Valuations, Despite Record Operating Results

The convenient thing about a company like Enterprise paying out all available cash flows in distributions, is that we can reference its valuation in terms of the current distribution yield. That’s because the distribution yield provides a proxy for Enterprise’s free cash flow yield (note: a higher yield means a lower valuation, and vice versa).

Using the yield as a valuation proxy, history suggests there’s little risk of valuation compression for Enterprise’s unit price from current levels. After all, Enterprise already trades at crisis-level yields, even as it generates record amounts of cash flow:

Clearly, the business is priced for maximum pessimism - trading at higher yields than during the 2014 - 2016 price collapse, and just below the spike in yields during the 2020 energy market collapse. And this is despite record operating results, a clean balance sheet and plenty of excess coverage on its current distribution.

What’s going on here?

We’re not dealing with an Enterprise-specific problem. Valuations remain depressed across the entire fossil fuel complex, given the rise of so-called “environmental, social and governance” (ESG) investment mandates. I won’t go off the rails into an ESG discussion here, except to say that the movement is completely at odds with reality on the ground. All data indicates the world is recovering towards new record highs in hydrocarbon consumption. Meanwhile, ESG is attacking the supply side through investment starvation, only setting the stage for higher prices and a potential energy crisis (in fact, we’re already seeing one in Europe).

Nonetheless, there’s no denying that we’re dealing with rampant investor pessimism across the energy space. This suggests one of two paths forward from here:

Energy sector valuations remain depressed indefinitely, or

Investors become less pessimistic and re-rate Enterprise’s valuation higher.

Most investors hate the prospect of option one and hope for option two. However, permanently depressed energy valuations could in fact prove excellent for Enterprise’s future prospects.

How ESG Could Deliver a Windfall to Enterprise Investors

Remember, Enterprise distributes all available cash flows back to investors. This means you can tune out the noise of the unit price - the company’s valuation could remain depressed forever, so long as it continues growing DCF, and thus growing the distribution. Now here’s the punchline…

In a world of impaired energy sector valuations, Enterprise is one of the best-positioned companies to consolidate the midstream industry and grow through acquisition rather than organic growth.

This a potential dream scenario for unit holders, by providing the opportunity for relatively low-risk DCF growth through attractively-priced acquisition targets. On the company’s Q3 earnings call, co-CEO Jim Teague dropped a hint that about the increasingly attractive valuations of potential M&A targets:

“I think maybe some valuations are little more -- are a little better.”

In an environment where Enterprise becomes a midstream consolidator at depressed valuations, we could see a dramatic acceleration in DCF growth from the current expected 1 - 2% range back to its historical 5 - 8% growth rate. In this scenario, even without any change in valuation, that could boost the forward return outlook to a range of 14.2% - 18.2%.

Given Enterprise’s low leverage ratio, the company is in a great position to flex its balance sheet for funding opportunistic acquisitions. Just because the hot money in the stock market doesn’t want to bid up Enterprise units doesn’t mean there isn’t robust demand for its debt. Management noted the ease and generous terms with which the company refinanced existing bonds during the recent Q3 earnings call:

“We were able to extend these (bond) maturities by 30 years while reducing the coupon of the debt by almost 0.5 percentage point. We would like to thank our fixed income investors for their continued support as this offering was -- had over $4 billion of demand on the busiest issuance day of the year.”

So if we enter an era of permanently depressed midstream (and other energy asset) valuations, I believe Enterprise can thrive through acquisition and consolidation. Meanwhile, this scenario would also help Enterprise avoid the inflation in new labor and material costs for building new midstream infrastructure - it could instead simply buy already-operating assets on the cheap: a true win-win scenario.

Finally, let’s consider the alternative scenario - where Mr. Market’s mood shifts from pure pessimism to something more closely resembling normalcy (i.e. not even optimism). Consider a highly simplistic picture to show what’s possible.

Let’s say management boosts Enterprise’s yield up to 9% in January, and Mr. Market then compresses the yield to 6% over the next five years. That would add another 8.5% compounded growth into the total return stream over a five year period. That easily boosts the forward return outlook comfortably above 15% real compounded growth, even in the low end of all other scenarios.

So, I think Enterprise has positioned itself in a win-win situation. Either midstream assets (and energy in general) remains out of favor, and thus ripe for consolidation among the strongest balance sheets, or investors re-rate the sector towards more normal valuation level.

And if you want to assume an optimistic case that includes greater opportunities for growth capex and thus DCF growth plus an uplift in valuations, you can easily get into the 20 - 30% range of compounded real returns over a five year time horizon. Given the growing potential for an energy crisis emerging within the next several years, driven by today’s lack of hydrocarbon investment, this scenario might turn out more plausible than it seems at first glance.

An Source of Stability in a Challenging Market

So to summarize, Enterprise enjoys the competitive advantage of a management team with substantial skin in the game and properly aligned incentives, who have proven themselves as excellent stewards of capital over time.

This capital stewardship has compounded into the enduring competitive moat Enterprise now enjoys through its massive scale of operations. This scale allows Enterprise to service customers faster, with greater operational flexibility and lower costs than its lesser-scaled competitors.

The stability of Enterprise’s business model and balance sheet allowed the company to breeze through two of the worst energy bear markets of all time. Today, it sports one of the cleanest balance sheets in its peer group and plenty of excess coverage over its existing distribution. The company is well positioned to participate in America’s ongoing NGL boom, and may also find cheap growth opportunities through acquisition in today’s environment of depressed sector-wide valuations.

Meanwhile, we’re living in a world of record high stock market valuations and junk bonds yielding 4 - 5%. The vast majority of the financial world offers miniscule forward returns that come with extreme risk.

Enterprise offers the rare opportunity for 15% compounded rates of return under arguably conservative assumptions, in a world-class business with a solid balance sheet and stable cash flow stream, offering a substantial margin of safety.

Meanwhile, you get paid a tax-advantaged inflation-protected 8.5% cash yield - which will likely continue growing from here.

On both a relative and absolute basis, there’s few better opportunities in today’s market.

Interested in more analysis like this? Hit the subscribe button below:

Looks like a another great research! Thanks Ross.